Home > Investor Relations > About JAPAN POST BANK

About JAPAN POST BANK

JAPAN POST BANK at a Glance

The History of JAPAN POST BANK

JAPAN POST BANK Co., Ltd. is a bank in the Japan Post Group, which was established in October 2007. The Bank provides comprehensive financial services to a wide range of individual customers, mostly through a nationwide network of post offices, with the aim of becoming "the most familiar and trusted bank".

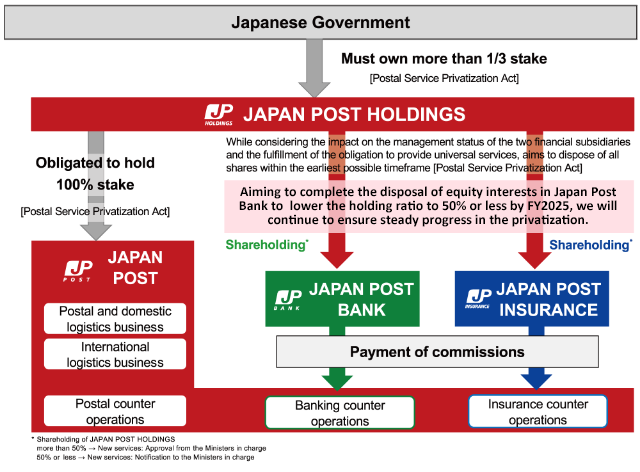

Our Position within Japan Post Group

Japan Post Holdings Co., Ltd., the parent company of JAPAN POST BANK, is required by the Postal Service Privatization Act to dispose of all its shares in the two financial services companies as soon as possible while it continues to uphold its universal service obligations. As of September 30, 2025, Japan Post Holdings holds approximately 49.89% of JAPAN POST BANK shares.

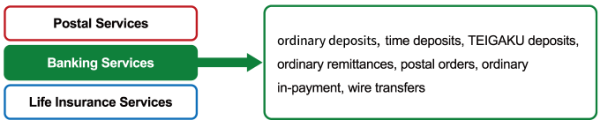

Universal Service Obligations

Under the Act on Japan Post Holdings Co., Ltd. and the Japan Post Co., Ltd. Act, Japan Post Holdings Co., Ltd. and Japan Post Co., Ltd. are subject to the universal services obligation, which obligates Japan Post Holdings and Japan Post Co. to provide postal services, simple savings, remittance and settlement services and easy-to-use life insurance services at post offices in all regions of Japan in an integrated, simplified and customer-oriented manner that preserves equal and convenient access to such services.

A unique bank that is indispensable to the community

Our main revenue comes from two sources: the Retail (fee and commission) Business, where we offer savings deposit services, remittance settlement, and asset management; and the Market Business, where we invest the savings deposits in securities and other investments across Japanese and international markets. Our market business contributes around 85% of our total revenue, which sets us apart from other major financial institutions.

Reference: Profit structure for the Bank

JAPAN POST BANK is a very unique bank that combines aspects of being one of Japan’s largest retail financial institutions with being one of Japan’s largest institutional investors.

JAPAN POST BANK

85%

Revenue from

Market Business

15%

Revenue from Retail

(Fee and Commission) Business

Average of

Major Financial Institutions

62%

Revenue from

Market Business

38%

Revenue from Retail

(Fee and Commission) Business

- Note 1: Revenue From Market Business = (net interest income + net trading profits + net other operating income) / gross operating profit

- Note 2: Revenue from Retail (Fee and Commission) Business = (net fees and commissions + trust fees ) / gross operating profit

- Note 3: Major financial institutions = Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group

Figures Showing JAPAN POST BANK’s Strengths

Strength 1

One of Japan’s largest customer bases and networks

Japan's Largest Customer Base

Number of ordinary deposit accounts (As of March 31, 2025)

Approx. 120 million accounts

Total deposit balance (As of March 31, 2025)

Approx. ¥190 trillion

Market Share (As of March 31, 2025)

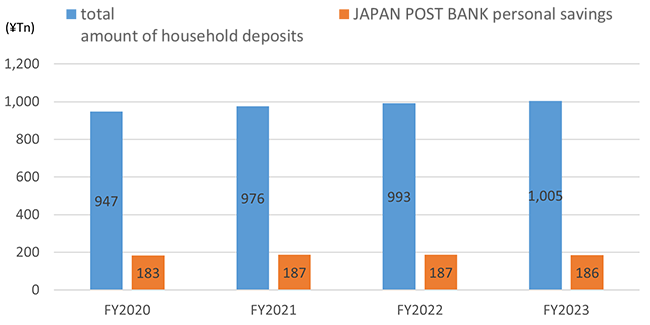

(the ratio of deposits at JAPAN POST BANK to the deposits of the household sector)

Approx. 20 %

Note: This figure represents JAPAN POST BANK personal savings divided by the total amount of household deposits in the Bank of Japan's "funding circulation statistics"

Trend of the total amount of JAPAN POST BANK personal savings and household deposits in the Bank of Japan's “funding circulation statistics”

The largest real network among all Japanese banks

Number of branches (As of March 31, 2025)

23,494 branches

Branch network comparison

(As of March 31, 2025)

Source: Japanese Bankers Association HP "Financial Statements of All Banks (Capital,Number of Branches,Number of Banking Agencies,Number of Officers and Employees List)"

*Total domestic head offices and branch offices (as of March 31, 2025)

Number of ATMs (As of March 31, 2025)

Approx.31,200 units

Strength 2

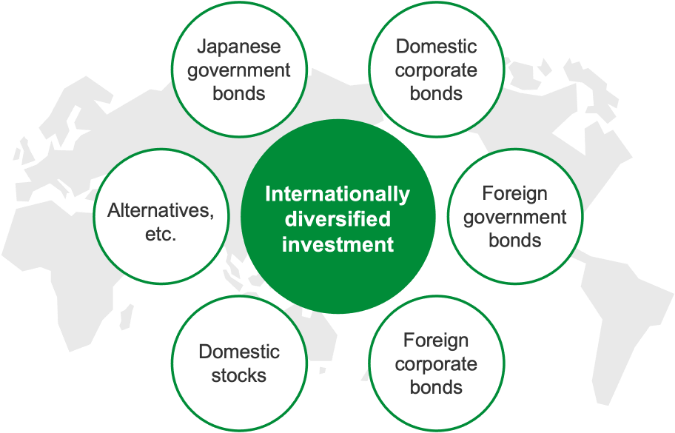

One of Japan’s largest Asset Managers

Total Assets under Management (As of March 31, 2025)

¥230.2 trillion

which includes

Total of Risk Assets (As of March 31, 2025)

¥107.9 trillion

- Note 1: Risk assets: Assets other than yen interest rates (JGBs, etc.)

- Note 2: Alternative assets: Private equity funds and real estate funds (equity), etc.

Private equity funds: Unlisted stocks, etc.

Strength 3

Diverse human resources

Market Operations Professionals (As of April, 2025)

90

Percentage of women in managerial positions (As of April, 2025)

19.8 %

Percentage of employees taking childcare leave

(regardless of gender) (FY2024)

99.7 %

Percentage of male employees taking childcare leave

(4 weeks or more) (FY2024)

78.8 %

Various awards including external assessments "White 500", "Platinum Kurumin", "Eruboshi (3 stars)", etc.

Growth Vision

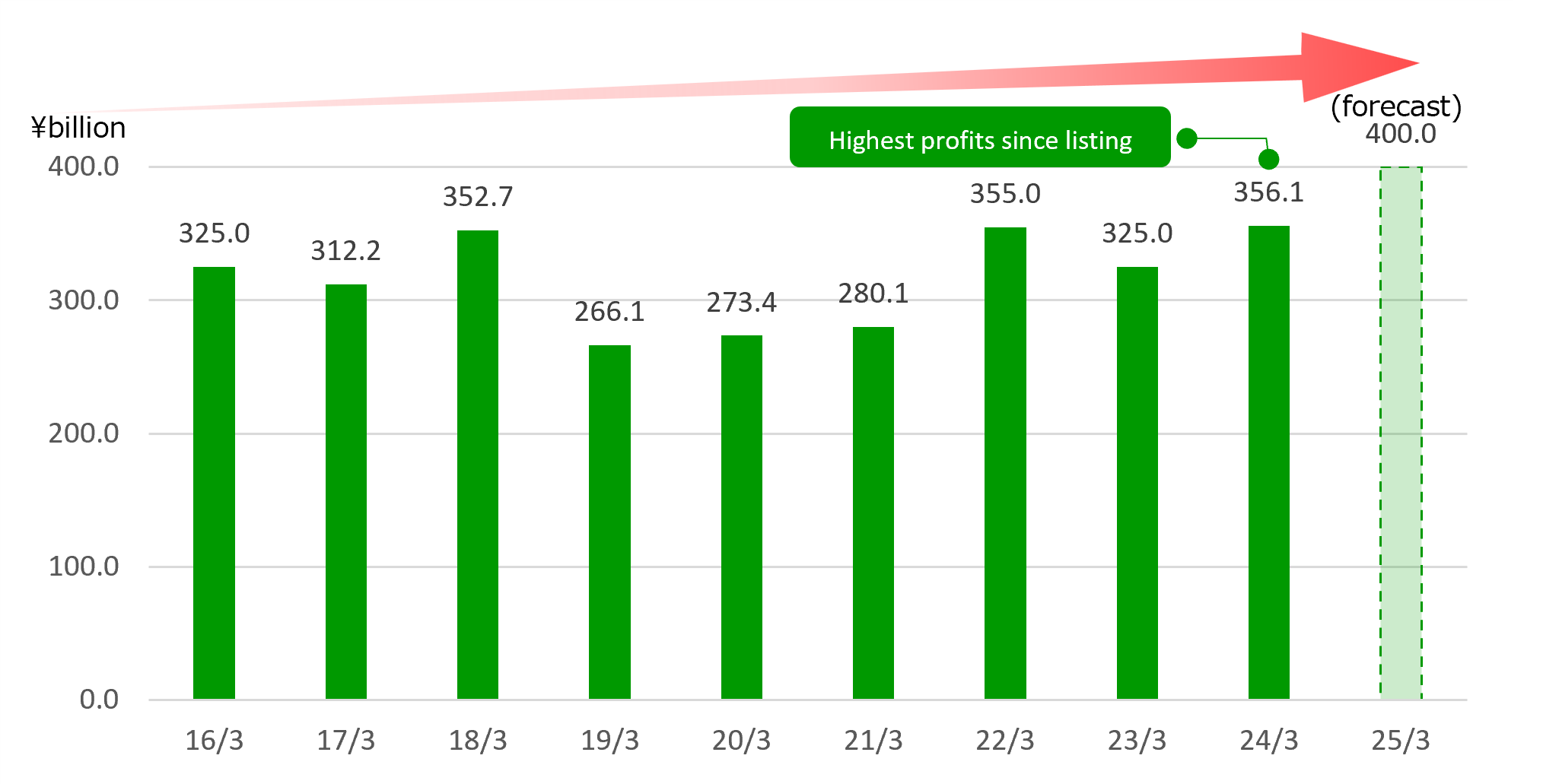

Financial Results Up to FY2024/FY2025 Earnings Forecast

We have secured stable profit by leveraging our unique strengths, which are having Japan’s largest customer base and real network and being one of Japan’s largest asset managers funded by stable funds.

Net Income

- Note1:Assumptions for the Earnings Forecasts

- ・Domestic and foreign interest rates will move in the line with the implied forward rates in early April 2025, considering recent changes in the financial markets.

- ・Foreign credit spreads will continue at the average levels in early April 2025.

- ・Foreign exchange will continue at the same levels in early April 2025.

- Note 2: 17/3; non-consolidated financial results, after18/3; consolidated financial results.

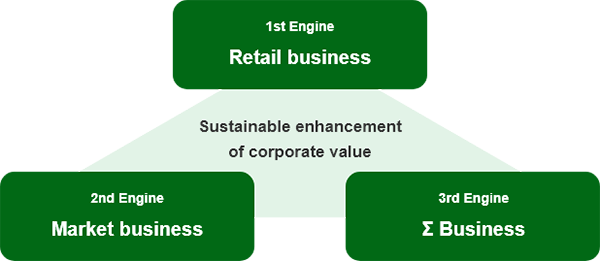

Going forward, we endeavor to strengthen our three growth engines: Retail Business, Market Business, and Σ Business*. We also aim to enhance corporate value and improve PBR through higher ROE.

*Σ Business: A corporate business for creating futures for societies and local communities through investment.

Three growth engines

Please click the link below for a detailed explanation of our medium-and-long-term strategy and management policy.

Our Shareholder Return Policy

Providing returns to our shareholders is one of our most important management goals. Our basic dividend policy is to provide stable divedends to shareholders while maintaining sufficient retained earnings for sound operations in light of the public nature of the banking business.

Shareholder return policy

- ・Considering the balance between shareholder returns, financial soundness, and investment for growth,our basic policy is to maintain a dividend payout ratio of approximately 50% during the period of the Medium-term Management Plan (FY2022/3-FY2026/3).

- ・However,based on the stability and continuity of dividends,the Bank seeks to increase the dividend per share (DPS) from the level of the initial dividend forecast for FY2025/3, by aiming for a payout ratio in the range of 50% to 60%.

Other policies pertaining to shareholder returns, etc.

- ・Consideration of share repurchases will be based on market conditions, performance and retained earnings, opportunities for investment in growth, and the Japan Post Group's policy for holding the Bank's shares.

- ・The Bank has implemented a shareholder special benefit program to show gratitude to shareholders for their ongoing support, and to increase the attractiveness of investment in the Bank's shares and thereby encourage more people to hold shares in the Bank.

(Notice Regarding the Introduction of a Shareholder Benefit Program) - ・Based on the status of the Bank's investment portfolio, the current policy is to pay dividends once a year, at the end of the fiscal year.