Home > Corporate Information > Management Strategy

Management Strategy

The revision of Medium-term Management Plan (FY2021 through FY2025)

In May 2021, the Bank formulated a Medium-term Management Plan (FY2021 through FY2025).

In the first three years of the plan, the Bank has been promoting the five key strategies set forth in the Medium-term Management Plan and has succeeded in attaining positive results, including achievement of the financial targets for FY2023 as planned and achievement of the financial targets for FY2025 ahead of schedule.

In parallel with these achievements, the business environment surrounding the Bank has been undergoing significant changes. The changes include rising interest rates in Japan and overseas; greater-than-expected advancements in the digitalization of society, such as the penetration of generative AI; and growing interest in the Bank’s actions to implement management that is conscious of cost of capital and stock price.

In light of these changes in the business environment, the Bank has revised its plan for the remaining two years of the Medium-term Management Plan, or FY2024-FY2025, in May 2024.

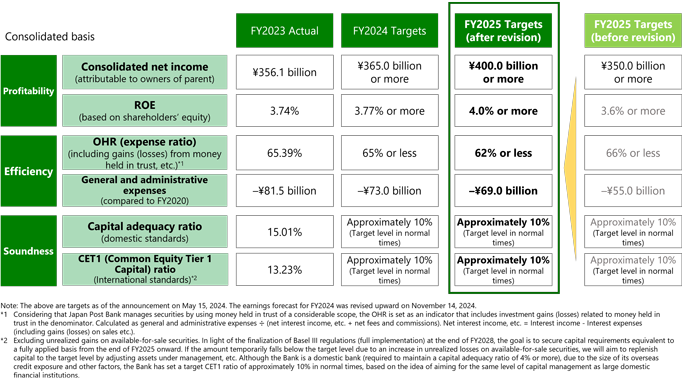

With regard to financial targets, the net income target for FY2025 has been revised upward to 400.0 billion yen or more*, from 350.0 billion yen or more, which was the target set at the time the Medium-term Management Plan was initially formulated, and other major financial targets have been revised in a similar manner.

- * This target is as of May 15, 2024. The Bank revised its earnings forecast for FY2025 upward from 470.0 billion yen to 500.0 billion yen on February 13,2026.

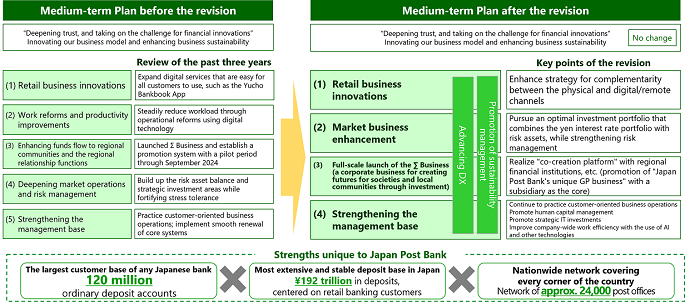

As for the business strategy, while maintaining the basic direction, the Bank will also look ahead to the next Medium-term Management Plan and revise the framework to focus on its strategies in three business domains — retail business, market business, and Σ (sigma) business (a corporate business for creating futures for societies and local communities through investment) — which leverage the Bank’s unique strengths, and accelerate the transformation to a sustainable business model by strengthening the management base that supports these strategies.

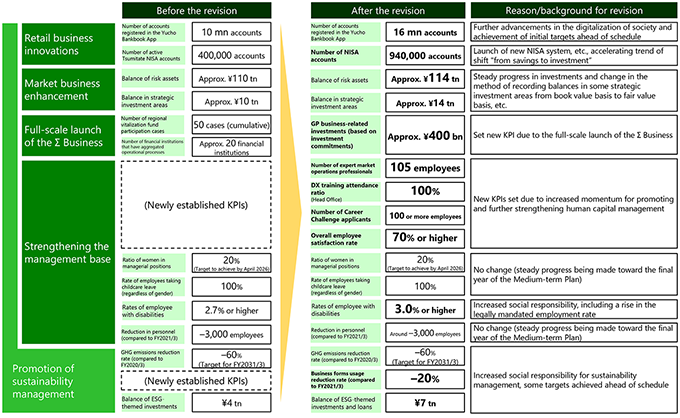

Key KPIs have been revised upward or newly established in accordance with the revised plan.

Through these efforts, the Bank aims to further enhance corporate value by continuously improving ROE while controlling the cost of shareholders’ equity.

Our Action to Implement Management that is Conscious of Cost of Capital and Stock Price

- Our price-to-book ratio (PBR) stood at 0.7 as of the end of September 2025, still below 1. We recognize that we still have a long way to go in improving our management to enhance corporate value, and we consider this to be a major management issue.

- According to the capital asset pricing model (CAPM), we recognize that the cost of shareholders’ equity for Japan Post Bank is approximately 5%, while the figure is approximately 6%–8% when using the earnings yield. Our current return on shareholders’ equity (ROE) performance (4.9% on shareholders’ equity basis and annualized basis for the Six Months Ended September 30, 2025) falls below this level. We believe that improving ROE to a level that exceeds the cost of shareholders’ equity will lead directly to improving PBR.

- The Bank has set an ROE target (on shareholders’ equity basis) of 4.7% or higher for FY2025, and we aim to achieve ROE of 5% or higher early in the next Medium-term Management Plan period. We will maximize the cycle of improving profits and enhancing corporate value while ensuring financial soundness and providing returns to our shareholders. In addition, fully understanding the expectations of our stakeholders, we will hold discussions on revising our ROE target upward, together with the direction of our management strategy, for the next Medium-term Management Plan.

For details, please see the attachment below.

- FY2025 H1 IR Presentation (PDF/2,792KB) (P6, 12 and 64)(PDF file)

- Annual Report 2025 (PDF/19,377KB) (P42)(PDF file)

JAPAN POST GROUP Management Policy

-

Group Medium-term Management Plan(Open in a new window)

(Jump to JAPAN POST HOLDINGS Website)