Compliance System

Basic Stance

Japan Post Bank defines compliance as "all officers and employees adhering to laws, regulations, internal rules, social norms, and corporate ethics, and acting to meet the expectations of customers, society and local communities, shareholders, and other stakeholders." We are striving to be the most trustworthy bank in Japan, and consequently we view compliance as an important management issue. Accordingly, we conduct rigorous compliance activities.

In addition, the "Japan Post Bank Code of Conduct" has been established and disseminated to all employees to ensure that each and every director and employee puts the customer first and acts responsibly. The guidelines consist of "strict compliance with laws, regulations, internal rules, social standards and corporate ethics", "responsibility to customers", "confrontation with antisocial forces", "respect for human rights", and "reporting and consultation".

Main contents

- Prohibition of unfair transactions such as the use of superior bargaining position and insider trading, etc.

- Prohibition of disclosure or leakage to third parties of personal or confidential information obtained in the course of business, or use of such information for other than its intended purpose, etc.

- Compliance with the principle of suitability, obligation to provide explanations, and thorough confirmation of customers' intentions, etc.

- We don’t discriminate or violate human rights on any grounds (race, nationality, creed, religion, gender, etc.).

- We will eliminate sexual harassment, power harassment, etc., and ensure a safe and comfortable work environment.

Compliance System

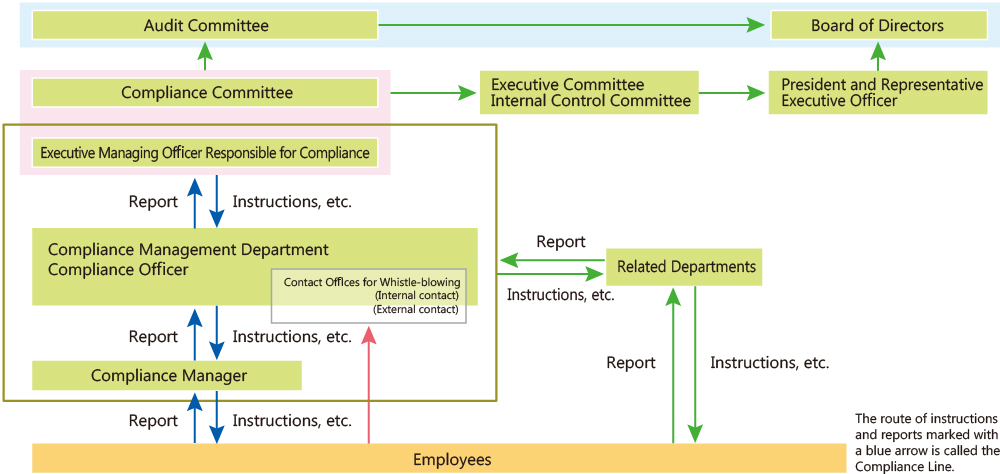

Japan Post Bank has established a "Compliance Committee" consisting of relevant officers to discuss important compliance-related matters and report on the status of promotion once a month.

The contents of these reports are discussed by the Management Committee and the Internal Control Committee, and then reported to the Audit Committee and the Board of Directors. The Board of Directors has a supervisory function regarding the operation status of the compliance system.

In addition, the Bank has established the Compliance Management Department under the leadership of the Executive Managing Officer responsible for compliance. The department formulates compliance promotion plans and manages their progress.

We have also appointed compliance officers in departments such as sales, who monitor the progress of compliance-related measures, as well as compliance managers in each department, who are responsible for mentoring employees and promoting compliance.

Compliance System

(As of September 1, 2022)

Japan Post Group Compliance Framework

Contact Offices for Whistleblowing

For the purpose of compliance risk management at Japan Post Bank, we have established an internal and external "Contact Offices for Whistleblowing" where employees can report directly (anonymous reporting is acceptable) any compliance problems or potential problems to prevent their occurrence or spread, and to resolve them as soon as possible.

We protect whistleblowers by thoroughly ensuring that they do not receive any disadvantage or unfair treatment, and employees who treat whistleblowers unfairly on the basis that they made a report are subjected to disciplinary action according to our internal rules.

In April 2021, we revised the Bank’s internal rules in order to allow more secure whistleblowing by clarifying the limits within which reports received at our contact offices will be shared and stipulating that information will not be provided beyond these limits for sharing without the consent of the whistleblower.

Furthermore, in April 2023, we began accepting whistle-blowing by telephone within the company.

In May 2024, in order to properly operate and make the whistle-blowing system more convenient, we introduced a system in which a neutral third-party organization (Complaint Review Board) consisting of multiple external experts, such as lawyers, responds to individual internal reports.

Japan Post Group's Whistleblowing System (Japanese Language Only)

Related Information

ESG Data - Corporate Governance: "No. of whistleblower reports"

Whistleblower System for External Stakeholders

Japan Post Bank accepts whistleblower reports from other parties with whom the Bank has contracts. These reports are handled in the same manner as those from employees.

Compliance Initiatives

Every year the Bank formulates a Compliance Program, which serves as a detailed action plan for the promotion of compliance. On the basis of this program, the Bank strives to promote compliance through addressing important matters and regularly checking their progress. The Bank also uses methods to strongly encourage compliance such as conducting training sessions for its executive officers and employees.

Moreover, the Bank formulated a Compliance Manual, which brings together the Bank's approach to compliance and important action items as well as the management of conflict of interest transactions, the prevention of corruption such as bribery of public officials and money laundering, and other laws and regulations to be complied with. The Compliance Handbook, which contains the most important items from the Compliance Manual is distributed to all executive officers and employees (including non-regular employees) and is used in compliance training sessions to ensure that all employees are thoroughly familiar with its contents and to raise compliance awareness.

Outline of Main Measures

- Prevention of fraud

- Anti-Money Laundering, Counter Financing of Terrorism, and Counter-Proliferation Financing

- Countering antisocial forces

- Customer-oriented business operations and customer protection

- Creating employee-friendly working environments

Procedures to investigate and follow up on any non-compliance identified

In the event that a compliance violation or suspected compliance violation is discovered, Japan Post Bank will investigate and clarify the facts and causes of the occurrence, and promote measures to prevent recurrence.

If, as a result of investigation and clarification, it is found that an employee has committed an act in violation of internal rules or laws and regulations, the Bank will take disciplinary action (salary reduction, dismissal, etc.) in accordance with the standards established by the Bank.

We also conduct fair personnel evaluations and treatment, such as checking the status of compliance with "compliance" as one of the job action evaluation items conducted throughout the year.

Measures against Countering Money Laundering, Financing of Terrorism, and Proliferation Financing

The importance of combating international money laundering, the financing of terrorism and proliferation financing is growing with each passing year. Financial and related institutions are being called upon to enhance the preventive measures toward their money laundering and related management systems in response to changes in money laundering and related risks.

Recognizing that the need to combat international money laundering, the financing of terrorism and proliferation financing is one of the major priorities for management, JAPAN POST BANK formulated the basic policy to address each of these issues in accordance with the requirements of international organizations such as the Financial Action Task Force (FATF) and the "Guidelines for Anti-Money Laundering and Combating the Financing of Terrorism" set forth by Japan’s Financial Services Agency. The Bank has also clarified the roles and responsibilities of all managers and employees involved in addressing international money laundering, the financing of terrorism and roliferation financing including the appointment of the dedicated executive officer in charge of the Compliance Division as the officer in charge of overall oversight for each of these issues. In doing so, JAPAN POST BANK is implementing management-driven measures.

Specifically, from the standpoint of preventing the Bank’s products and services from being abused for the purpose of international money laundering, the financing of terrorism and proliferation financing, the Bank identifies the relevant risks and evaluates and takes appropriate measures to effectively mitigate these risks.

In recent years, the incidence of various financial crimes has become increasingly frequent with the methods used more cunning and sophisticated. In order to safeguard customers’ deposits and assets, JAPAN POST BANK will engage in efforts to prevent financial crimes from occurring and their further proliferation through a variety of measures. This includes analyzing past criminal typologies, enhancing the Bank's systems, and consolidating data.

JAPAN POST BANK's main preventive measures against money laundering, the financing of terrorism and proliferation are as follows.

- The roles and responsibilities of officers and employees involved in addressing money laundering, the financing of terrorism and proliferation have been clarified, including the appointment of the dedicated executive officer in charge of the Compliance Division as the officer in charge of overall oversight for addressing money laundering and related risks.

- An organizational framework and internal rules have been established to appropriately implement countermeasures against money laundering, the financing of terrorism and proliferation in accordance with relevant laws and regulations.

- Measures are implemented to continuously manage customers, both at the commencement of and following transactions, such as the opening of accounts.

- As customer management measures, the identity of customers, the purpose of their transactions, and other matters such as beneficial owners are verified using reliable information (including identity verification for non-face-to-face transactions). Customers are also checked to verify whether they are subject to economic sanctions such as those determined by the United Nations Security Council, etc.

- Necessary risk mitigation measures are implemented in accordance with the level of risks for money laundering, the financing of terrorism and proliferation. For the commencement of transactions with high risk customers, such as those suspected of identity theft or foreign PEPs (Politically Exposed Persons), more stringent measures are taken, including upper-management approvals.

- Documents and records related to the prevention of money laundering, the financing of terrorism and proliferation are preserved in accordance with relevant laws and regulations. (For example, documents and records related to the transaction verification are preserved for seven years from the start of the transaction.)

- Training is conducted for officers and employees to thoroughly disseminate information on obligations and requirements concerning money laundering, the financing of terrorism and proliferation.

- The effectiveness of risk mitigation measures is independently verified periodically and as necessary by the second and third line of defense departments.

- A framework is established to provide the information on suspected victims of investment fraud directly to the police for supporting their swift action.

Related Information

Request regarding transaction confirmations, etc. (Japanese Language Only)

Identification documents for Opening an Account(Japanese Language Only)

Request to customers who use international remittance services (Japanese Language Only)

Measures against Antisocial Forces

Japan Post Bank as an organization combats against Antisocial Forces that threaten the sound social order and corporate activities. The Bank is never involved in any illegal or antisocial behavior associated with antisocial forces. The Bank blocks and excludes relationships with antisocial forces by cooperating with relevant external organizations such as the police, etc.

Related Information

Basic Policy for Combating against Antisocial Forces

Framework in place for the elimination of antisocial forces

- (1)

- Internal Rules

The Bank outlines the specific details of its internal rules based on the above Basic Policy. - (2)

- Response Management Department and Unreasonable Demands Prevention Officers

The Bank has established a Response Management Department responsible for ensuring the Bank is not involved in relationships with antisocial forces. The department carries out planning and management etc., of the Bank’s response to antisocial forces. Unreasonable Demands Prevention Officers have also been staffed in locations such as our headquarters and branches, in charge of countering unreasonable demands from antisocial forces. - (3)

- Alliances with external specialist organizations

The Bank’s branches etc., respond to antisocial forces through alliances with external specialist organizations, such as the Center for Removal of Criminal Organizations. As part of normal practice, we also build close relationships with the organizations such as the police, reporting to them in the event of emergencies, and we engage in consultation with lawyers whenever necessary. - (4)

- Collection and management of information relating to antisocial forces.

The Response Management Department for antisocial forces is responsible for the collection of information relating to antisocial forces and arranging a system for its integrated management. - (5)

- The Bank has created a manual outlining a specific framework for responding to antisocial forces in order to facilitate a systematic and integrated response.

- (6)

- Training activities

The Bank recognizes its response to antisocial forces as an important matter concerning compliance, and it is working to properly educate employees through compliance training, etc.

Measures Aimed at Managing Conflicts of Interest

The JAPAN POST GROUP has released the Japan Post Group Conflicts of Interest Management Policy. This Policy governs the management of conflicts of interest transactions by our Group as a whole in order to prevent our customers’ interests from being unduly harmed.

In line with this Policy, Japan Post Bank has put in place a system for the proper management of transactions that have the potential to create conflicts of interest and to prevent customer interests from being unduly harmed. Among a host of initiatives, the Bank has set up the Compliance Management Department to assume responsibility for managing and controlling conflicts of interest.

Related Information

Conflicts of Interest Management Policy

Anti-Bribery Initiatives

To prevent bribery, as well as inappropriate payoffs and their enjoyment, the Bank has established rules for when entertaining or exchanging gifts with business partners or government officials, and it is providing education about these rules through means such as training.

Specifically, the Bank has established rules stipulating that employees must obtain the approval of their supervisor before providing or receiving entertainment or gifts. Additionally, through the Compliance Handbook, directors and employees are made aware that the giving of gifts to government officials and accounting auditors is prohibited by law, and that they must not accept any inappropriate payoffs.

Implementation of Information Security Measures

Japan Post Bank has established regulations on information security based on the "Japan Post Group Information Security Declaration" to protect and safely manage customers' important information assets from threats to their confidentiality, integrity, and availability. We strictly comply with these regulations.

In addition, we conduct ongoing information security education to ensure that all employees recognize the importance of information security and raise their awareness. To maintain and enhance our information security, we continuously inspect, review, and improve our measures.

Initiatives to Raise Director and Employee Awareness Regarding Compliance

Japan Post Bank is implementing compliance training through a range of different methods to raise the awareness of our directors and employees (including non-regular employees) in regard to compliance. These methods include lectures by experts with diverse knowledge, newsletters to help staff fully understand internal rules, video training that present real examples, and e-learning to reinforce knowledge about compliance.

We are striving to be the most trustworthy bank in Japan, and we are working to raise awareness of compliance through implementing diverse types of training in light of changes in our social and business environment.

Training Topics

- Anti-Money Laundering, Counter Financing of Terrorism, and Counter-Proliferation Financing

- Prevention of insider trading

- Protection of personal information and information security

- Harassment prevention