Customer Protection

Customer Protection

The Bank has taken measures to protect customers so that that they are able to use our services securely.

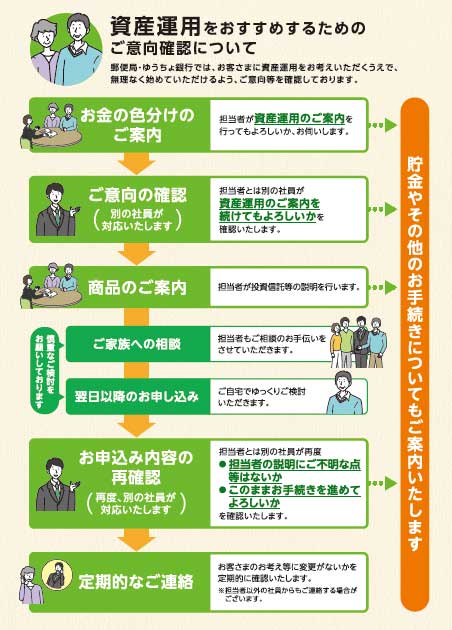

Providing Customer-oriented Information and Consulting Services

When proposing asset management products, we will ask about your thoughts on your life plan and your current financial situation, and then we will make proposals for products that match your life plan. In addition, when providing products and services, we provide easy-to-understand information to help ordinary deposit customers choose the most suitable products, such as explaining the important information they need to know when choosing a product, while comparing products using materials that include information on fees and risks.

Employee Training

We view ensuring customer-oriented business operations and compliance (such as observing laws and regulations) as an important management issue and we are conducting compliance training for all employees.

Following the revision of the Act for Eliminating Discrimination against Persons with Disabilities in April 2024, we have informed all employees of the revised content and are continuing to deepen mutual understanding through "constructive dialogue" and implement careful responses that take into account the needs of people with disabilities. In addition, we are thoroughly ensuring considerate and respectful responses by all employees, with continued emphasis on fostering mutual understanding through constructive dialogue.

Expansion of customer sales tools

In FY2021/3, we revised the contents of our pamphlet for elderly customers so that they could more securely purchase asset management products.

Specifically, in addition to amending the pamphlet’s information so that elderly customers could better understand the necessity of asset management, we made changes to the design such as enlarging characters so that they could be more easily visible for elderly customers.

Implementation of follow-up services

Since FY2020/3, JAPAN POST BANK and Post Office employees have continued to provide-follow up services for all elderly customers using investment trusts.

Introduction of Senior Life Advisors

To provide high-quality and courteous service to our elderly customers, we are placing senior life advisors at some of our direct branches.

Reviewed sales targets and personnel evaluation systems

In order to advance customer-oriented sales, in FY2022/3 we thoroughly revised sales targets and personnel evaluation systems so that they would place greater emphasis on "sales quality" over "sales results," and "customer-oriented perspectives" over "product-oriented perspectives."

Strengthening customer-oriented business operations

To further promote and implement customer-oriented business operations, we have established a special committee directly under the President & CEO, Representative Executive Officer. This committee builds a cycle for directly incorporating customer and employee feedback into management decisions.

We are working across the organization to create new value not only through the improvement and enhancement of products and services but also through the facilitation of internal communication and the resulting improvement of organizational capabilities. Members from different sections, positions, and years of experience listen sincerely to the voices of our customers and employees, make bottom-up proposals to management, and engage in lively discussions.

Related Information

Privacy Protection Measures

Having recognized that protecting personal data, including specific personal information and Individual Numbers is vital to offering services that can achieve a high degree of customer satisfaction, the Bank has established a privacy policy and conducts business operations based on this policy.

The Compliance Management Department at the head office identifies and confirms compliance issues, including privacy issues.

We have established a person responsible for the handling of personal information, and have established a system for reporting to and communicating with the person responsible in the event that a fact or indication of a violation of laws, regulations, or handling rules is detected. We have also established an appropriate management system by preparing regulations for personal information protection and conducting annual personal information protection training for all employees.

The Company conducts periodic self-inspections of the status of personal information handling, as well as audits by other departments and outside parties.

In addition, "Compliance Status" is included in the individual performance evaluation items, and evaluation is conducted by checking for any compliance violations such as leakage of personal information. In the event of a leakage of personal information, the Bank implements measures to protect personal information, including disciplinary action and other strict measures in accordance with standards established by the Bank.

In the event that a compliance violation or suspected compliance violation is discovered, the Company will investigate and clarify the facts and causes of the occurrence, and promote measures to prevent recurrence.

Japan Post Group's Initiatives for the Protection and Management of Customer Information

Under the revised Act on the Protection of Personal Information which was enforced in April 2022, it is provided that leakage of personal data which is highly likely to damage individual rights and interests shall be reported. The number of cases reported in accordance with the said law during FY2024 was thirty-eight.

The breakdown of each fiscal year is shown in the table below.

【Reference Information】Breakdown by fiscal year according to the categories set forth by the Act on the Protection of Personal Information, etc. as classified by the Japan Post Group

| FY2022 | FY2023 | FY2024 | FY2025 (1Q) |

|

|---|---|---|---|---|

| Sensitive personal information: | 20 | 4 | 5 | 1 |

| Subject to property damage if wrongfully handled: | 22 | 19 | 22 | 6 |

| Leakage that may have been caused for wrongful purposes: | 4 | 2 | 5 | 0 |

| Number of individuals listed on personal data exceeds 1,000: | 0 | 2 | 6 | 1 |

| Total | 46 | 27 | 38 | 8 |

*Quoted from the Japan Post Co., Ltd. website

Related Information

Japan Post Group Compliance Framework(Japanese)

Information Security Protection in System Procurement

To ensure that all customers can use our services safely and securely, the Bank has established strict internal regulations and rules for the procurement of systems that handle important information such as customer data. For example, the Bank has established a specialized department to confirm security requirements, and always includes information security requirements in specifications and contracts to protect customers’ valuable information. Even after contracts are concluded, the Bank continuously checks the working environment and management systems of business partners, and thoroughly protects and manages information based on clear rules.

Prevention of Specific Fraud Cases Including Bank Transfer Scams

The Bank cooperates with the police and takes various measures to ensure customers are protected from financial damage relating to bank transfer scams and other types of fraud. Also, based on the Criminal Accounts Damages Recovery Act,* funds in accounts used for crime are seized and distributed to customers who have been affected in accordance with the amount of financial damage.

- *:

- Act on Damage Recovery Benefit Distributed from Funds in Bank Accounts Used for Crimes, enacted June 2008.

Related Information

Beware of financial crime! (Japanese version only)

Measures for the prevention of special fraud cases

- Strengthening of screening when accounts are opened, including the refusal to open accounts for people with a history of fraudulent account use.

- Freezing accounts and denying the opening of new accounts for persons whose names match those appearing in the "frozen account holder list," which is provided by the police and lists accounts used in the past for crimes such as bank transfer scams and investment fraud.

- Distributing warning flyers and displaying warnings on ATM screens. (In the event that we receive a deposit or refund that we suspect is part of a bank transfer scam, we explain the situation to the customer and request an explanation by the police.)

- Notice to customers who may have suffered significant losses by potential fraud.

- Recommending customers reduce the maximum withdrawal limit on their accounts.

- We concluded an information sharing agreement with the National Police Agency to prevent the spread financial damage relating special fraud cases.

Financial Inclusion Initiatives

As the super-aged society progresses, the local economy is shrinking due to a declining population, and an increasing number of towns and villages have no private financial institutions other than post offices. Japan Post Bank provides savings and remittance services to customers in every corner of Japan through its nationwide network of approximately 24,000 post offices, and we recognize that our activities contribute to solving social issues. Based on the SDGs philosophy of "leaving no one behind," we will continue to listen to the voices of our customers and provide a variety of services as the most accessible bank to everyone in Japan, including those in remote areas.

Additionally, the Bank has established the Basic Policy for Fiduciary Duties, which states that the Bank will "respond to a wide range of diverse customer needs including the reinforcement of cashless payment services and digital services," "seek to improve and innovate our products and services based on customer comments received," and "provide accurate consulting and reliable office services in response to diverse customer needs in asset management and other areas, we will foster staff equipped with the specialist knowledge to enable them to carry out their duties appropriately," etc. We provide appropriate support for elderly and disabled customers through employee training and other programs on how to deal with them.

Related Information

Basic Policy for Fiduciary Duties

Various Initiatives

Japan Post Bank offers a full range of services to ensure that customers can use our services with peace of mind.

For example, we provide services such as "New Welfare Time Deposit," "Telephone relay service," and "Retirement Pension Delivery Service."

| Service name | Summary |

|---|---|

| New Welfare Time Deposit | This is a one-year fixed-term deposit available for those receiving public pensions such as Disability Basic Pension or Survivors’ Basic Pension, as well as Child Rearing Allowance. We apply an interest rate that includes an additional fixed rate on top of the standard one-year fixed-term deposit interest rate. (Within the usage limit for fixed-term deposits (13 million yen), each individual can deposit up to 3 million yen.) *Customers with disabilities or bereaved family members can utilize the ‘Tax Exemption Scheme for Interest on Small Savings (Maruyu). |

| Telephone relay service | Japan Post Bank has adopted the telephone relay service to help customers with hearing disabilities follow various procedures, etc. This service covers all procedures and inquiries that can be handled by telephone. *The telephone relay service is a service in which a sign language interpreter operator facilitates the communication of those with hearing or speech disabilities by translating sign language or text into speech. |

| Retirement Pension Delivery Service | A service where staff home-deliver pension payments each payment month for customers, such as the elderly living on their own, who have difficulty in coming to a Japan Post Bank branch or a post office to receive their payments. |

| Multilingual support | We are promoting multilingual support so that foreign customers can use our services safely and securely. For example, small ATMs are available in 16 languages for visitors using the International ATM Service (Withdrawals for cards issued abroad). In addition, we offer a service on our website that allows you to prepare the necessary documents for opening an account in advance from your home PC or other devices (available in 16 languages). (As of September, 2025) |

| Financial Education | With the spread of credit cards and electronic money, financial troubles in which young people are involved are becoming more diverse, and Japan Post Bank believes that it is our responsibility as a financial institution to contribute to the improvement of financial literacy to help solve these problems. We provide financial education for elementary, junior high, and high school students, including visiting classes at schools. Using our original teaching materials, we help children develop a proper sense of money by conveying the importance of money and how to deal with it. |

| Provision of wide group credit life insurance on intermediary housing loans by Sony Bank | In Sony Bank’s intermediary housing loans, wide group credit life insurance from Credit Agricole Life Insurance Company Japan Ltd. is available. This insurance is designed to make it easier for those with health reasons (pre-existing conditions, pre-existing diseases, etc.) to join by relaxing the underwriting standards compared to general group credit life insurance. *Not all people with health reasons are eligible for this insurance, and some may not be able to enroll depending on the results of the screening process. *Sony Bank housing loans are subject to enrollment in Sony Bank designated group credit life insurance. If you do not have group credit life insurance, you will not be able to use the housing loan. *Japan Post Bank is a bank agency with Sony Bank as its affiliated bank and can act as an intermediary for Sony Bank housing loan applications. |

| Investment Trust Cancellation Delegation Service | The Investment Trust Cancellation Delegation Service allows a designated agent to cancel investment trusts held in the account holder’s investment trust account with our bank on behalf of the account holder, in the event that the account holder’s decision-making ability declines in the future, by applying in advance (delegating to the designated agent). |

Related Information

Provision of High-quality, Customer-oriented Financial Services