Provision of High-quality, Customer-oriented Financial Services

Basic Stance

Japan Post Bank aims to become "the most accessible and trustworthy bank in Japan," guided by the needs and expectations of our customers. We aspire to provide "reliable and thorough" financial services "safely and securely" to anyone and everyone throughout Japan.

Customer-oriented Business Operations

In order to actively respond to the diverse needs of our customers through services such as asset building support and our existing deposit and remittance services, Japan Post Bank adopted the "Principles for Customer-oriented Business Conduct" that were announced by the Financial Service Agency of Japan in March 2017, and in June of the same year we established our "Basic Policy for Fiduciary Duties." We also disclose details of our initiatives concerning our customer-oriented business operations and the status of these initiatives on our website.

Related Information

Basic Policy for Fiduciary Duties

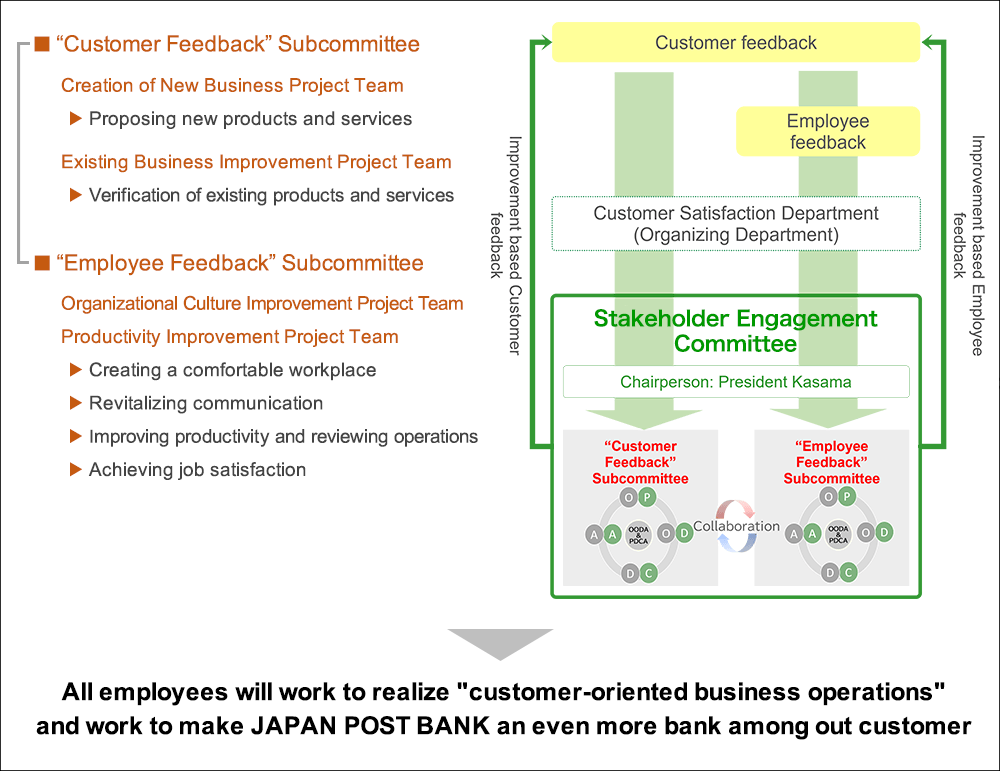

Establishment of Stakeholder Engagement Committee

With the aim of further promoting and implementing customer-oriented business operations, we have established the "Stakeholder Engagement Committee", a special committee made up of the President and Representative Executive Officers and other key members of management, and we are using "Customer feedback" and "Employee feedback" to improve and enhance our products and services.

In June 2024, with the aim of becoming a bank that is even more trusted, the Committee was reorganized as a cross-departmental organization, and in addition to improving and enhancing products and services, members with different departments, positions, and years of experience sincerely listen to the "Customer feedback" and "Employee feedback" and make bottom-up proposals to the management team, including the president.

Overview

Related Information

Framework for applying customer opinions within business activities

Provision of High-quality, Customer-oriented Financial Services

Support of asset building

Based on customer-oriented business operations, the bank is providing optimized services to our customers through "Face-to-face channels," where customers can consult with their usual staff members, as well as simple, convenient, and low-cost "Digital channels."

Along with organizing our asset-management product line-up in our face-to-face channels into simple products, we will mainly promote cumulative-type investments to our beginner-level investment customers. Also, through actions such as implementing and expanding an online consultation function and the development of consultant, we are striving to deliver life plans and consulting that closely centers on our customers.

In the digital channels, we are expanding our website and app-based services and maintaining an asset management platform that anyone can easily use under No purchase fee.

In addition, from May 2024, JAPAN POST BANK has started a service that initial consulting service at no fee.

Holding seminars

In order to answer the diverse needs of our customers, we are holding seminars helpful for understanding market trends and improving knowledge regarding finance and investing. In addition to face-to-face meetings at our stores, we hold a variety of seminars, including online seminars that you can participate from your home, and video-based seminars that you can watch at your own convenience, in order to provide financial and investment knowledge to our customers.

Expanding digital services that a wide range of customers can readily use

Utilizing the nationwide post office network, we are working to expand digital services that are easy for all customers to use, with safety and security as our top priority. Specifically, we are working on strengthening the security of various digital services such as identity verification functions, expanding the functions of the "Yucho Bankbook App", releasing the PFM (Personal Financial Management) app "Yucho Reco", and continuously improving the UI/UX.

We are also promoting the construction of an open "Co-creation Platform" that leverages our customer base and provides optimal services through collaboration with a variety of businesses.

Furthermore, with Japan Post's smartphone payment service, Yucho Pay, JAPAN POST BANK will pay a certain amount based on the amount of payment made using Yucho Pay at stores, and will donate the money to volunteer organizations. We are working with our customers to contribute to society through shopping.

Going forward, we will continue to work to expand our customer base in the digital domain, with a focus on the "Yucho Bankbook App", leveraging the number-one customer base of Japanese banks that we have established to date. We will strive to popularize our digital services that can be used safely and conveniently by many customers.

Development of new services that heighten convenience

We are engaging in the development of new services that will provide long-term support for the lives of our customers and create greater convenience for them.

Support for foreign customers

In January 2017, we introduced compact ATMs with functions such as support for 16 languages*1, and they are being installed nationwide in places including FamilyMart.

We have also created a service on our website that allows customers, before actually coming to the service desk, to use their own PC to prepare documents such as application forms required for procedures when opening a bank account. The service supports multilingual including English, Chinese, Vietnamese, etc., allowing customers without strong Japanese to easily use it.

The "Yucho Tetsuzuki App", which was launched in March 2024, allows customers to open accounts and reset PINs using their own smartphones, without having to visit a branch. In order to make it easier for customers who are not confident in their Japanese to complete the necessary procedures, the account opening process is available in English, Chinese and Vietnamese as well as Japanese*2.

- *1:

- Limited to withdrawals for cards issued abroad.

- *2:

- PIN reset is available in Japanese and English.

Related Information

Open a bank account

Developing human resources to support our services

We are enhancing our customer services so that a wider range of customers can use Japan Post Bank. Through actions such as the training of CS (customer satisfaction) promotion leaders, training with external instructors, and watching DVDs for learning purposes, we are striving to increase our customer service skills.

We also conduct surveys of ordinary deposit customers who have used our services to check the quality of our responses and make improvements. Furthermore, we are encouraging employees to participate in dementia-supporter-training, having endorsed initiatives for supporting people with dementia based on The New Orange Plan (a plan for the promotion of strategies to help dementia) established by the Ministry of Health, Labour and Welfare, in collaboration with concerned government ministries. By FY2024, about 16,400 employees had participated in the training.

Products to support customers

We are providing products and services to support our customers such as the Retirement Pension Delivery Service,*2 and New Welfare Time Deposits.*3

- *2:

- A service where staff home-deliver pension payments each payment month for customers, such as the elderly living on their own, who have difficulty in coming to a Japan Post Bank branch or a post office to receive their payments.

- *3:

- With this service, we offer a one-year time deposit up to ¥3 million with preferential interest rates for recipients of certain pensions and allowances, such as the disability basic pension, the basic pension for surviving family, and child-rearing allowances, which are given to people with disabilities or surviving family members.

Related Information