JAPAN POST BANK Priority Issues

Positioning of Priority Issues (Materiality) in Management

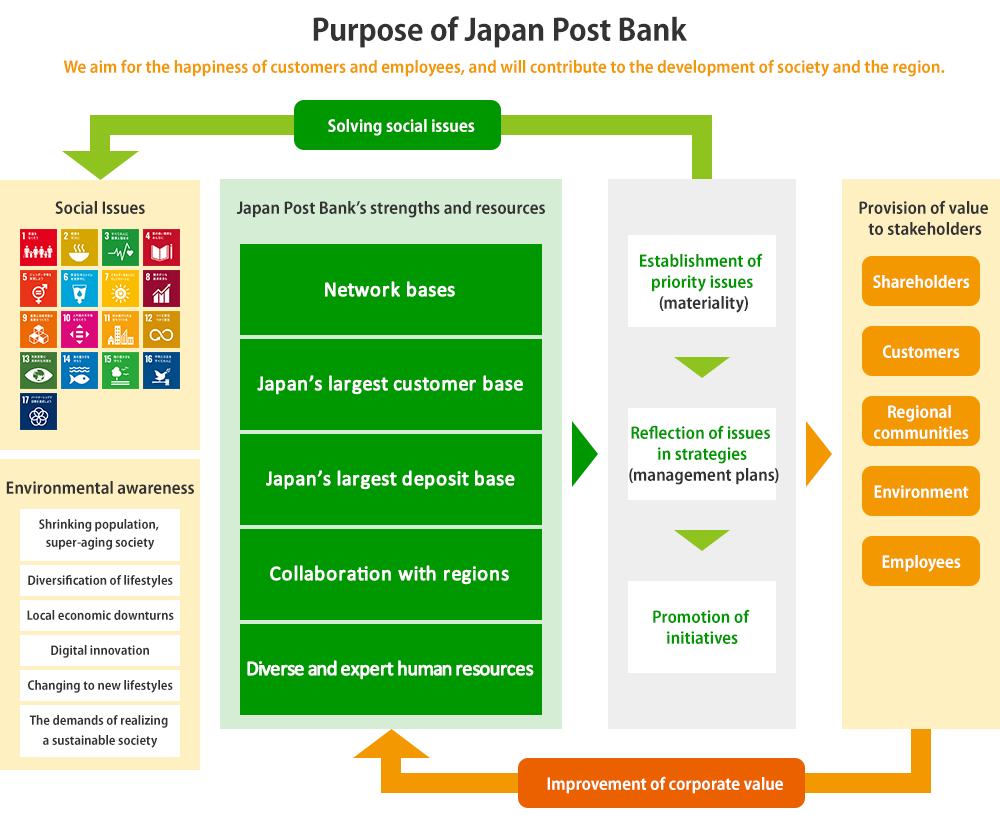

Japan Post Bank is engaging in the advancement of ESG management, which combines both corporate value enhancement and the solving of social issues. At the basis of this is a “cycle of value creation” – an approach that involves working to solve social issues and provide value to our various stakeholders through our business activities, which in turn is linked to the enhancement of our corporate value.

Related Information

Management Strategy

Priority Issues (Materiality)

In our Medium-term Management Plan that commenced in FY2022/3, we established priority issues (Materiality) that our company should focus on.

These have been selected from the issues that we, as a “chosen bank that continues to grow with society,” must focus on in our processes that deliver value to our stakeholders such as our customers, regional communities, the environment, and our employees. By returning to the fundamentals of our business and specifying these priority issues, we can realize the importance of growing in harmony with society, and our employees can strive to achieve this goal.

Furthermore, for each of these priority issues we have established target KPIs to manage our progress.

Relevance to Materiality

For each of the four materiality issues, we are working to minimize risks and maximize opportunities by sorting out risks and opportunities.

| Priority Issues (Materiality) |

Risks and Opportunities | Specific Initiatives | Target KPIs(FY2026/3) | Connection to social issues (Realizing SDGs) |

|

|---|---|---|---|---|---|

|

Risks |

|

|

|

|

| Opportunities |

|

||||

|

Risks |

|

|

|

|

| Opportunities |

|

||||

|

Risks |

|

|

|

|

| Opportunities |

|

||||

|

Risks |

|

|

|

|

| Opportunities |

|

||||

*1

Abbreviation of Task Force on Climate-related Financial Disclosures. An organization established at the proposal of the Financial Stability Board for the purpose of thoroughly realizing corporate information disclosure pertaining to climate change, in which the representatives of the central banks and financial supervisory authorities, etc. of key nations participate.

*2

Abbreviation of Sustainable Development Goals. International goals for the period between 2016 to 2030, stated in “The 2030 Agenda for Sustainable Development” adopted at a United Nations summit in 2015.

The Process of Identifying Materiality

| Step 1: Identifying social issues to be considered |

|---|

|

Through the methods below, social issues were identified as comprehensively as possible.

*3 Abbreviation for the Carbon Disclosure Project. An international NPO that manages the disclosure of information regarding the environmental impact of corporations, etc. *4 An international framework that supports the achievement of sustainable growth, proposed by the Secretary-General of the United Nations at the 1999 World Economic Forum. *5 Abbreviation for the Global Reporting Initiative. An international NPO that establishes guidelines for sustainability reports. |

| Step 2: Narrowing down social issues to be addressed | |

|---|---|

| From among the social issues identified, the Bank narrowed down the social issues to be targeted by the Bank, based on the Bank's perpasses, management philosophy, and business activities, and also reflecting the evaluation results of external research organizations and the opinions of external experts. | |

|

Social issues are examined based on Japan Post Bank’s management philosophy, policies, services, and business details, and those with low relevancy to our business activities are removed. |

|

In consideration of information such as assessment results from external research agencies and external expert opinions, it is determined whether the issues selected are based on what society demands of the bank. |

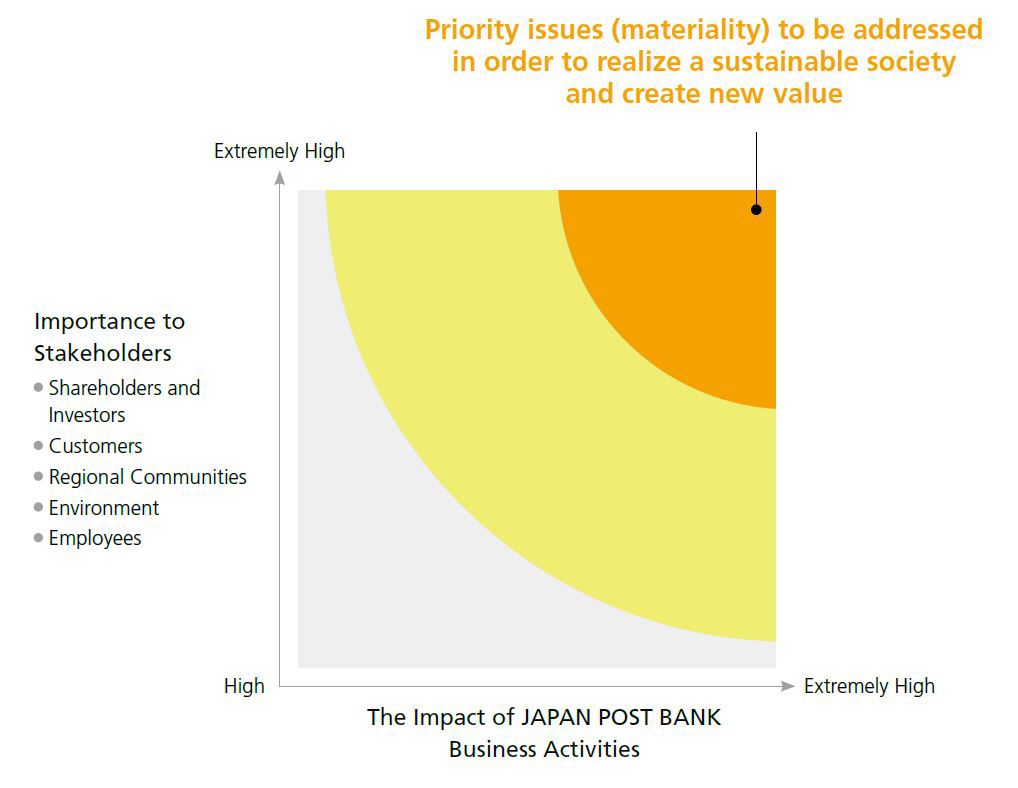

| Step 3: Creating a "Materiality Map" |

|---|

|

We created a “Materiality Map” –outlining and sorting priority issues using the two criteria of “importance to our stakeholders” and “the impact of Japan Post Bank business activities” For "Impact of Japan Post Bank's Business Activities," based on the impact of Japan Post Bank's business activities on society and the environment, social issues that have a significant impact on Japan Post Bank are mapped as those that are highly relevant to its business activities.  |

| Step 4: Identifying Priority Issues (Materiality) |

|---|

|

The Management Committee and the Board of Directors review the appropriateness and identify four materiality issues. The Management Committee and the Board of Directors confirm the status of progress at their meetings once a quarter. * In FY2020, the Bank identified its first materiality issues in the formulation of its medium-term management plan (FY2021-FY2025). Thereafter, the materiality will be reviewed at least once every two to three years, taking into account changes in the social environment and the Bank's initiatives.  |