Home > Investor Relations > IR Library > Annual Report > Message from the Executive Officer in Charge of Financial and Capital Strategy

Message from the Executive Officer in Charge of Financial and Capital Strategy

Makoto Shinmura

Senior Managing Executive Officer

Corporate Planning Department, ALM Planning Department, Research Department, Investor Relations Department, IT Strategy Department

We aim to enhance corporate value through sustained improvement in ROE

Entering the final year of the Medium-term Management Plan (FY2021‒FY2025)

In FY2024, amid ongoing geopolitical tensions around the world, some regions, such as Europe and China, experienced an economic slowdown, whereas the United States maintained a robust economy. However, the United States is also showing signs of major change following the presidential election.

In Japan, amid the continued depreciation of the yen and rising prices, the Bank of Japan changed its interest rate policy, which led to an increase in deposit interest rates, making the transition to a “world with positive interest rates” more tangible.

Japan Post Bank steadily advanced the restructuring of its yen interest rate portfolio, which had been planned for some time, promoting a shift from deposits to investments in Japanese Government Bonds (JGBs). At the same time, we hedged foreign exchange and interest rate fluctuations in advance and invested in risk assets while flexibly controlling risk in response to changes in the financial markets. As a result, we were able to secure profits that exceeded our initial plan.

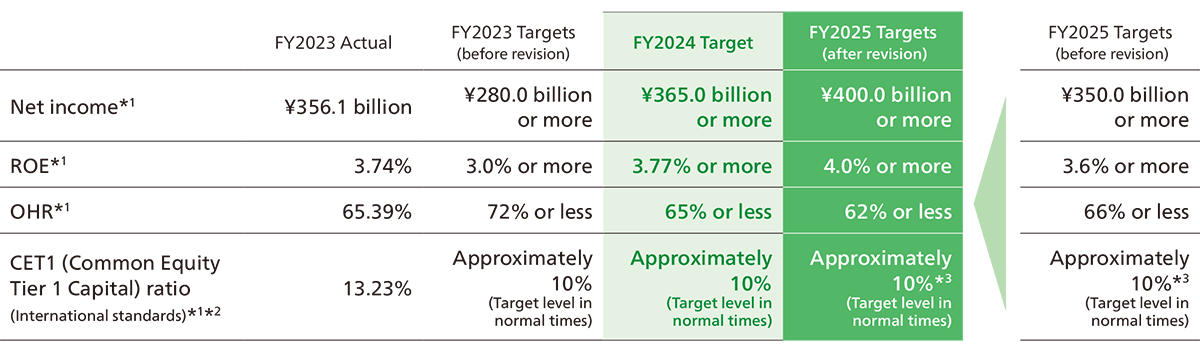

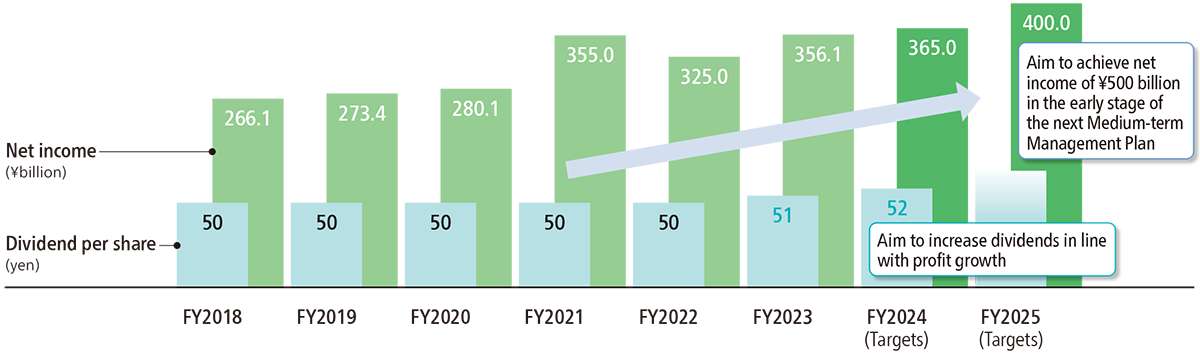

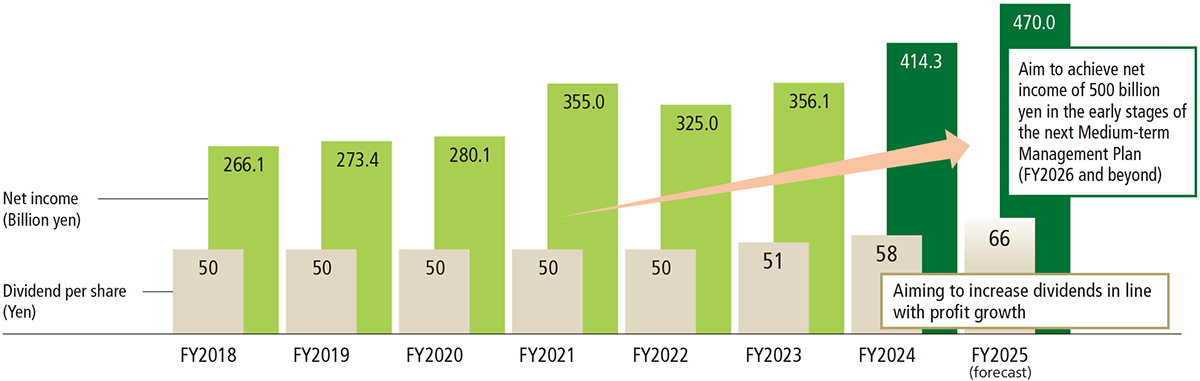

Consolidated net income for FY2024 reached 414.3 billion yen, achieving record profits for the second consecutive fiscal year and enabling us to achieve the financial targets of “net income of 400 billion yen or more” and “ROE of 4% or more” set out in our Medium-term Management Plan one year ahead of schedule.

We also increased the dividend by 6 yen from the initial forecast for the fiscal year to 58 yen per share. Since listing in 2015, we have maintained a dividend of 50 yen, and we believe that the successive dividend increases in line with profit growth, to 51 yen in FY2023 and 58 yen in FY2024, represent a major step forward for Japan Post Bank.

In addition, Japan Post Holdings, the parent company of Japan Post Bank, conducted a secondary offering of its shares in the Bank in March 2025, following its March 2023 offering, based on the policy of reducing its shareholding in Japan Post Bank to 50% or less by FY2025. Japan Post Holdings voting rights in Japan Post Bank fell below 50%, and restrictions under the Postal Service Privatization Act were partially relaxed (the approval system for new business regulations was replaced by a notification system). This will give Japan Post Bank greater freedom in its management and, together with the various measures it has been promoting, such as maintaining and improving the regional financial infrastructure through cooperation with other financial institutions, will create an environment in which it can move forward with greater speed.

FY2025 will be the final year of the Medium-term Management Plan that started in FY2021. Recognizing the changes in the domestic and overseas business environment as a tailwind, we will steadily promote three business strategies (Retail Business, Market Business, and Σ Business) that leverage our unique strengths, achieve record profits for the third consecutive fiscal year, and make this a year of preparation for taking Japan Post Bank to the next stage.

Achievements and Review of Financial Targets

- *1 Consolidated basis; ROE is based on shareholders’ equity, and OHR includes profits (losses) on money held in trust, etc.

- *2 Excluding unrealized gains on available-for-sale securities.

- *3 Based on the final and fully implemented Basel III.

Sustainable enhancement of corporate value

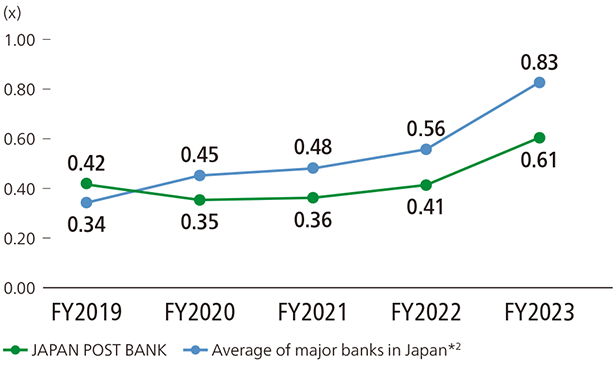

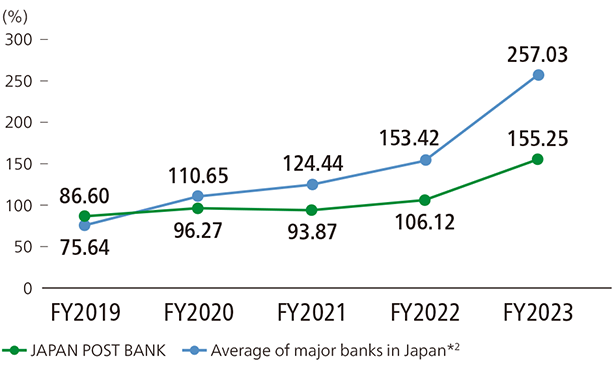

Although we achieved an increase in profits for the second consecutive fiscal year in FY2024, our price-to-book ratio (PBR) remained at 0.60 (as of March 31, 2025), almost unchanged from the previous fiscal year and still below 1. We recognize that we still have a long way to go in improving our management to enhance Japan Post Bank’s corporate value, and we consider this to be a major management issue. In addition, our total shareholder return (TSR) is lower than that of major banks.

- *1 Calculated based on the stock price and net asset value per share at the end of each fiscal year. Fractions less than one unit are rounded to the nearest whole number.

- *2 Simple average of Mitsubishi UFJ Financial Group, Mizuho Financial Group, and Sumitomo Mitsui Financial Group.

- *3 Total shareholder return (TSR) is calculated as (stock price at the end of each fiscal year + cumulative dividends per share (DPS) for the eight fiscal years prior to the current fiscal year) ÷ stock price at the end of the fiscal year nine years prior to the current fiscal year.

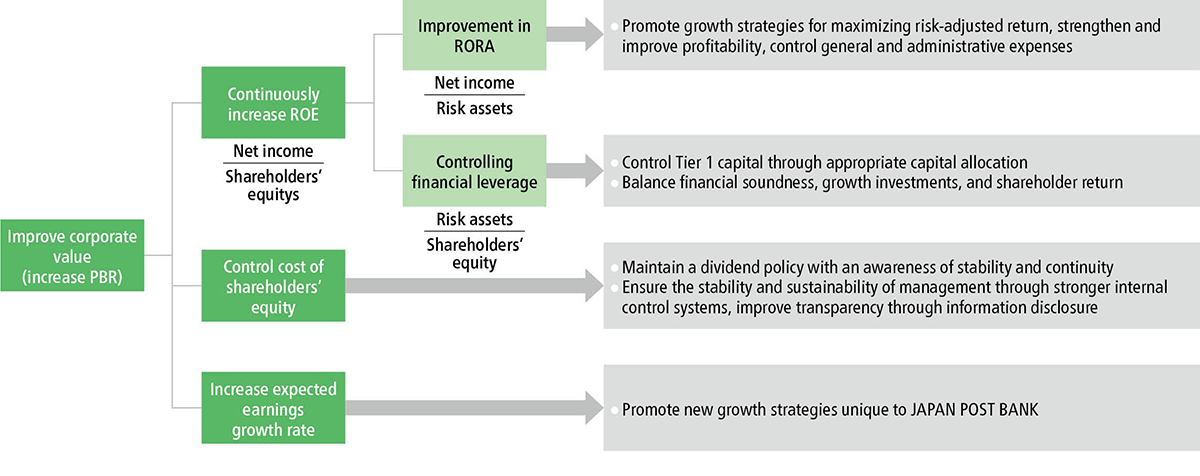

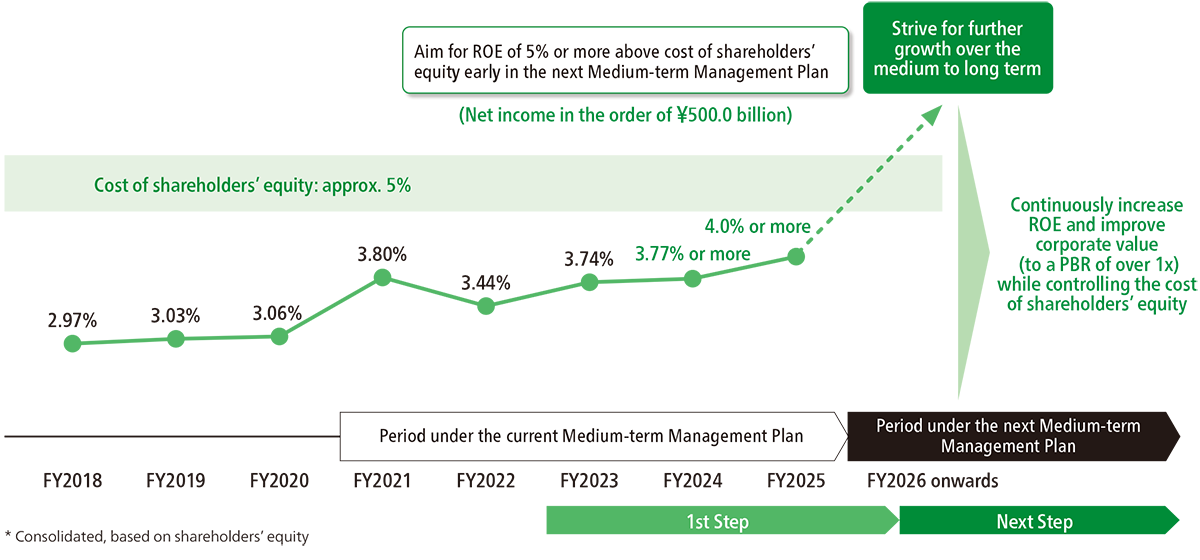

Japan Post Bank considers three drivers for improving PBR: “sustained improvement in ROE,” “control of the cost of shareholders’ equity,” and “improvement in the expected earnings growth rate.” Among these, we consider improving ROE (return on equity) to be the most important. We believe that improving ROE will lead directly to enhancing corporate value (improving PBR).

In FY2024, we achieved our final target for the Medium-term Management Plan of 4% ROE one year ahead of schedule, and our ROE has been steadily improving, but we are not satisfied with the current level.

In FY2025, we aim for ROE of 4.7% or higher, and from FY2026, when the next Medium-term Management Plan begins, we will promptly achieve 5%, which we consider to be the first step toward the target, and then continue to improve the ROE dramatically.

Factors contributing to PBR improvement (Logic tree)

Toward sustainable improvement in ROE

With the aim of improving ROE, Japan Post Bank has divided its specific strategies into two categories: “improving risk-adjusted returns” and “controlling financial leverage” through the integrated promotion of the three businesses mentioned above.

- Notes:1 The dotted lines indicate a simplified image of the results if market assumptions (implied forward rates as of early April 2025) are realized.

- Notes:2 The cost of shareholders’ equity and the medium-to long-term ROE targets for the next Medium-term Management Plan are currently under discussion.

1. Improve risk-adjusted returns

- Promote growth strategies, strengthen and improve earning power -

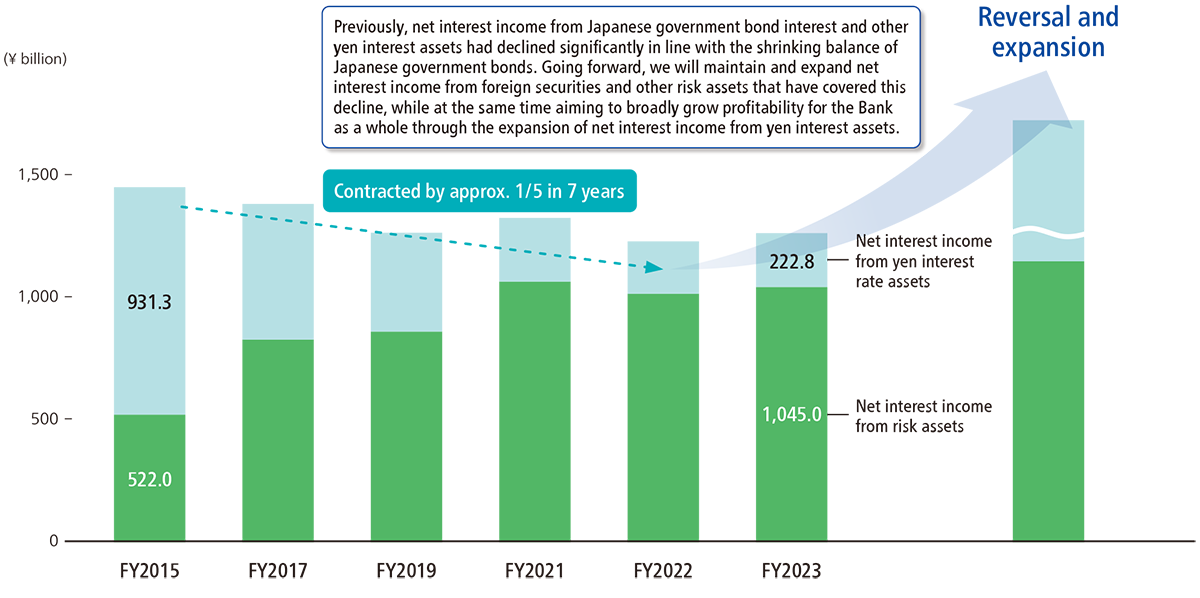

In the Market Business, which supports Japan Post Bank’s earnings, we will continue to steadily promote the restructuring of yen interest rate portfolios through a shift in investments toward Japanese Government Bonds (JGBs), riding the tailwind of rising domestic interest rates, in addition to risk assets (alternative assets such as private equity in addition to corporate bonds), which we have traditionally focused on. We aim to achieve significant growth in total earnings while maintaining a balance between the two.

Japan Post Bank mainly invests in 10-year JGBs and other long-term bonds, and compared to financial institutions that provide medium-term loans with floating interest rates the effects of profit growth will accumulate over time and appear in subsequent fiscal years.

Increase in income from the yen interest rate portfolio

The source of funds for our market business is deposits exceeding 190 trillion yen entrusted to us by approximately 120 million customers through our nationwide network of post offices and branches. To further improve the convenience of our retail business, which is centered on deposits from long-standing customers, Japan Post Bank is focusing on the digitization of various services. For example, the Yucho Bankbook App, which was being used by more than 13 million customers as of March 31, 2025, has grown into one of our main customer channels as a digital channel, in addition to physical channels such as bank counters and remote channels such as financial contact centers. We intend to utilize these channels as a financial platform to provide not only our own products but also those of partner companies, thereby enhancing convenience for our customers while increasing our fee income.

Furthermore, in our domestic private equity investment (Σ Business), which began full-scale operations in FY2024, we are steadily moving toward future profitability by establishing our core subsidiary, Yucho Capital Partners, and launching multiple funds with partner companies.

As described above, we aim to expand earnings through growth strategies that are unique to Japan Post Bank in each business area.

- General and administrative expenses -

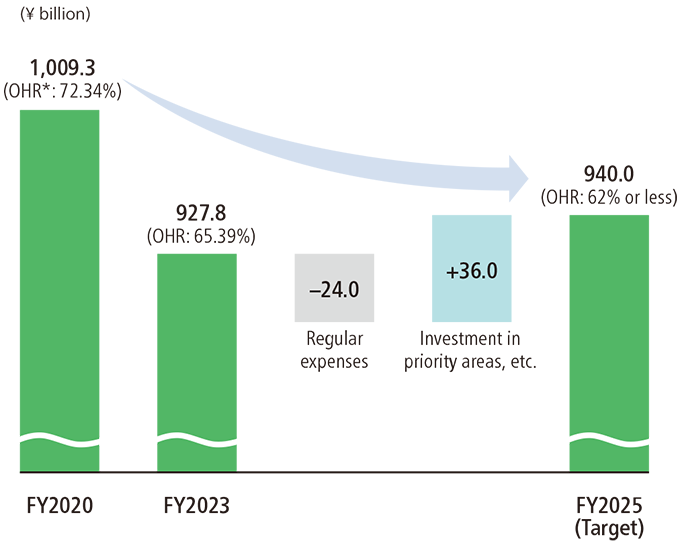

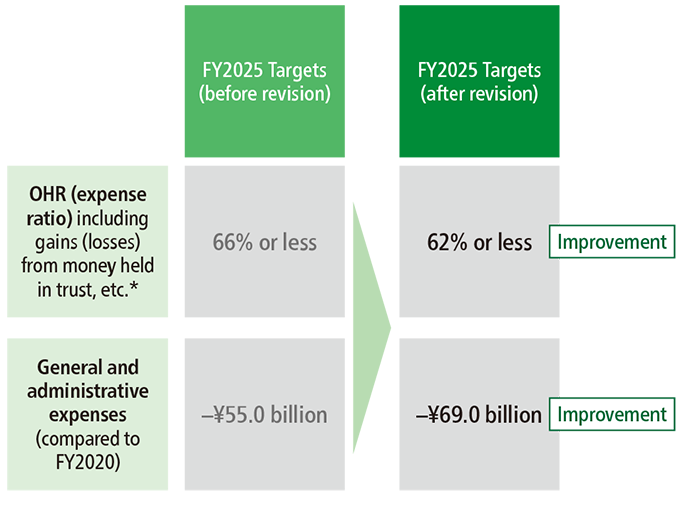

In addition to strengthening earning power, controlling expenses is an important factor in achieving sustainable improvement in ROE. While promoting DX, AML/CFT/CPF*, and cybersecurity, and investing in priority areas such as improving employee treatment and increasing the number of employees in key areas, we will continue to reduce regular expenses through administrative efficiency. Our financial target for efficiency (OHR) is 61.38% for FY2024, and we have been steadily reducing it during the Medium-term Management Plan period.

We will continue to control expenses in a focused manner, including by taking on the challenge of fundamentally transforming our operations through the active use of AI.

* Prevention of money laundering and terrorist financing.

(changes in general and administrative expenses) (consolidated)

- *1 Japan Post Bank has set OHR as an indicator that includes gains (losses) on money held in trust in the denominator, given that it manages securities on a scale commensurate with its size. Calculated as general and administrative expenses divided by (Net interest income, etc. + Fees and commissions income). Net interest income, etc., is calculated as interest income minus interest expenses (including gains (losses) on sales).

- *2 Includes contributions to the Organization for Postal Savings, Postal Life Insurance and Post Office Network.

- Note: The totals for the increases and decreases in FY2024 (actual results) do not match the figures for FY2025 (plan) due to rounding and other factors.

2. Control of financial leverage (control of Tier 1 capital through appropriate capital allocation)

Japan Post Bank’s capital policy is based on the following three principles: 1) maintaining sufficient capital and ensuring financial soundness, 2) strengthening earning power through growth investments utilizing capital, and 3) aiming to return profits to shareholders.

- Financial soundness -

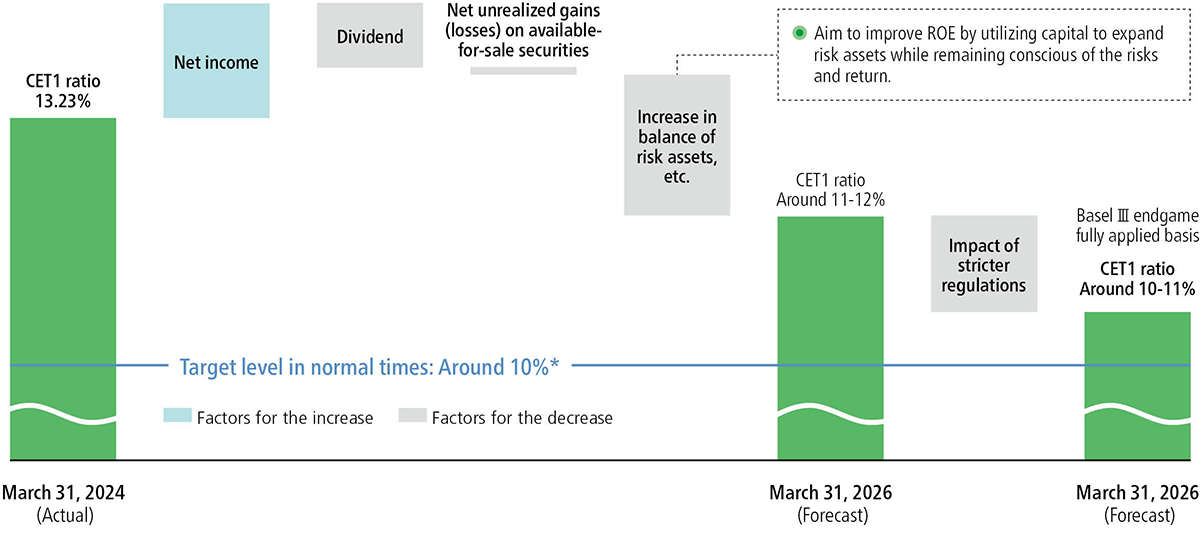

Although Japan Post Bank is a domestic bank (regulatory capital adequacy ratio: 4% or more), it aims to manage capital at the same level as major domestic financial institutions due to the size of its overseas credit exposure. For internal management purposes, it has set a target level of around 10% for its CET1 ratio, which is the international standard for banks with international operations. As of March 31, 2025, the CET1 ratio was 11.77%, indicating that the Bank has a certain amount of leeway. We will strive to ensure financial soundness by enhancing and upgrading our monitoring systems to quickly identify changes in the domestic and overseas environment and by conducting stress tests.

- * Excluding unrealized gains on available-for-sale securities. Based on the full application of Basel III regulations at the end of FY2028, the Bank aims to achieve full compliance from the end of FY 2025 onward. If the ratio temporarily falls below the target level due to an increase in unrealized losses on available-for-sale securities, the Bank will strive to restore the ratio to the target level through adjustments to investment assets. Although Japan Post Bank is a domestic bank (regulatory capital adequacy ratio: 4% or more), based on its large overseas credit exposure, it aims to maintain capital management at the same level as large domestic financial institutions and has set a target level of around 10% for the CET1 ratio in normal times.

- Growth investments (investments that offer high risk-adjusted returns) -

To improve ROE, we will make investments that lead to improved return on risk assets (RORA) while considering strategic investments that contribute to the medium- to long-term growth of Japan Post Bank and improvement of ROE.

- Strengthening shareholder returns -

Shareholder returns are one of the most important themes in our capital policy. Considering the balance between financial soundness and growth investments, our basic policy is to maintain a dividend payout ratio of around 50% during the current Medium-term Management Plan period. We have set the dividend per share for FY2024 at 58 yen, an increase of 7 yen from the previous fiscal year, with the aim of increasing the initial dividend forecast for FY2024 (52 yen).We also plan to increase the dividend per share for FY2025 by 8 yen from FY2024 to 66 yen and will continue to increase dividends in line with profit growth.

From March to May 2025, when Japan Post Holdings, Inc., sold its shares in Japan Post Bank, we repurchased treasury stock totaling approximately 60 billion yen.

Net income and dividend per share (consolidated)

Control of cost of shareholders’ equity

According to the capital asset pricing model (CAPM), the cost of shareholders’ equity for Japan Post Bank is calculated to be approximately 5%. However, we consider this to be a reference value calculated using a single method and under certain conditions (when using the dividend yield, the figure is approximately 6%‒8%). Taking into full consideration the expectations of our stakeholders, we will hold discussions on viewing the cost of shareholders’ equity from a more comprehensive perspective, together with the direction of our management strategy, for the next Medium-term Management Plan, and will engage in dialogue with investors.

At the same time, regardless of the level of the cost of shareholders’ equity, we will continue to pursue a dividend policy that takes into consideration stability, continuity, and growth, while strengthening our business base by enhancing internal control procedures and promoting human capital management. We will also strive to disclose information appropriately, including through investor relations activities.

Improvement in the expected earnings growth rate

- Enhancing corporate value through ongoing dialogue with stakeholders -

As the financial institution with the largest retail network in Japan and as one of the world’s leading institutional investors, Japan Post Bank aims to be “the most familiar and trusted bank” and has been working to enhance corporate value by promoting three business strategies (Retail Business, Market Business, and Σ Business) that go beyond traditional banking.

We hope that the sale of our stocks in March 2025 will greatly expand our business opportunities and potential, but our long-term goals remain unchanged.

We want to continue to be “the most familiar and trusted bank,” and we believe that this can be achieved not by competing with other companies but rather by providing a platform that enables us to co-create with other partners to deliver the services that our customers demand.

We receive many questions from our stakeholders, including shareholders and investors asking how Japan Post Bank will change and what our specific outlook is, reflecting their expectations for our new businesses. At this stage, we can only say that details are forthcoming, but I am currently engaged in lively discussions with our motivated employees about the future and our growth story as a financial platform provider. We will continue to communicate the direction indicated by our compass and the specific path we will take through integrated reports and investor relations activities, so we ask for your continued support and look forward to walking this new path together with you.

FY2025 is the year in which our Medium-term Management Plan comes to fruition. We will continue to ensure financial soundness while enhancing profits and corporate value and strive to maximize the cycle of returning profits to our shareholders. We will also take the evaluations and opinions of our stakeholders seriously and reflect them in our next Medium-term Management Plan. We look forward to your continued understanding and support.

IR Activities (FY2024)

| Activities | Details |

|---|---|

| 18th Ordinary General Meeting of Shareholders (FY2024) | Held on June 18, 2024 |

| Briefings for individual investors | The Bank holds briefing sessions for individual investors led by the managements. Number of sessions: 5, Number of participants: 1,043 |

| Investors Meeting | President & CEO, Representative Executive Officer, Member of the Board of Directors holds half-yearly meetings mainly for institutional investors and analysts. Number of sessions: 2, Number of participants: 248 |

| Interviews with institutional investors and analysts | The Managing Executive Officer in charge of the IR department, together with other members of the management team, including President & CEO, Representative Executive Officer, Member of the Board of Directors, holds individual meetings with institutional investors and analysts in Japan and overseas. Companies met with: 522 (including 284 overseas institutional investors) |

| Conferences for institutional investors hosted by securities firms | The Bank participates in conferences hosted by securities firms, and the Managing Executive Officer in charge of the IR Department holds individual interviews with overseas institutional investors. Number of attended conferences: 5 |

| Other IR events | The Bank holds briefing sessions for small groups of analysts and institutional investors regarding revision of the Medium-term Management Plan and revision of the earnings forecasts led by the management team, including President & CEO, Representative Executive Officer, Member of the Board of Directors. |

| 19th Ordinary General Meeting of Shareholders (FY2025) | Held on June 24, 2025 |

- ●Overview of the revision of the Medium-term Management Plan

- ●Overview of upward revisions to the fiscal 2024 earnings forecast and dividend forecast for fiscal 2024

- ●Progress of the restructuring of yen interest rate portfolios

- ●Outlook for business expansion through deregulation

- ●Future growth strategies and dividend policy

- ●In response to requests for clarification of key messages, executive summary pages were added to Investors Meeting materials

- ●Disclosure of earnings simulations based on yen interest rate increases

- ●Continued disclosure of progress in restructuring yen interest rate portfolios

- ●Disclosure of future business plans after the Offering