Climate Change Initiatives

JAPAN POST BANK has set forth in its Basic Sustainability Policy and Environmental Policy that it will engage in environmentally friendly activities and work to resolve environmental issues to protect nature and the environment and pass them on to future generations, and it is promoting the reduction of greenhouse gas (GHG)* emissions and other initiatives.

Complying with the TCFD Recommendations

JAPAN POST BANK announced its agreement with the TCFD Recommendations in April 2019, and has been making disclosures in accordance with the TCFD framework. For more details, please visit “Complying with the TCFD Recommendations” under Related Information.

Related Information

Complying with the TCFD Recommendations

Japan Post Bank Net Zero GHG Emissions Declaration

Recognizing that climate change, which has a serious impact on the society and the economy, is an important issue, we announced the Japan Post Bank Net Zero GHG Emissions Declaration in March 2022. To achieve the targets of the Paris Agreement, we are implementing various measures to reduce the impact of climate change and are working to improve efficiency, such as through conserving energy.

Japan Post Bank Net Zero GHG Emissions Declaration

- Recognizing that climate change, which has a serious impact on the society and the economy, is an important issue, we have endorsed the Paris Agreement and are implementing and supporting initiatives that contribute to mitigating and adapting to climate change.

- We aim to achieve net zero GHG emissions (Scopes 1 to 3) for the Bank and the finance portfolio by 2050.

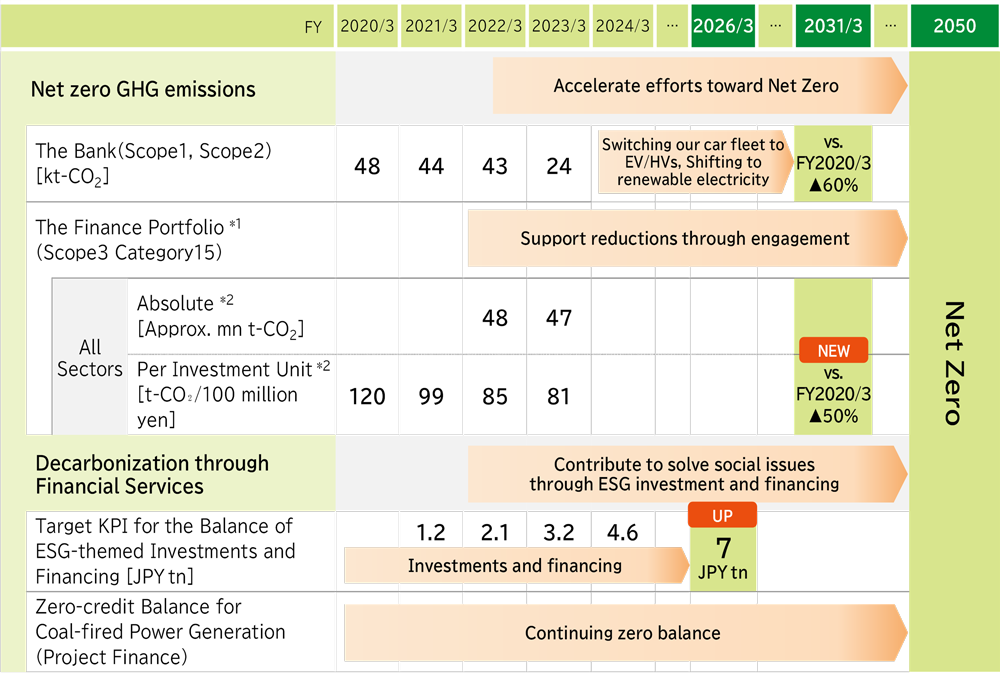

Roadmap to Decarbonization

- Note 1:

- In FY2022, we raised our GHG emissions reduction target from -46% (compared to FY2019) to -60% (compared to FY2019) based on progress in reducing GHG emissions, including the use of renewable energy for electricity consumption at our own facilities.

- Note 2:

- In FY2022, to more specifically promote the achievement of 2050 net-zero GHG emissions in the finance portfolio, emission intensity target for power generation sector was newly set as an interim target for FY2030 (other sectors are under consideration).

Targets and Results for Reducing GHG Emissions

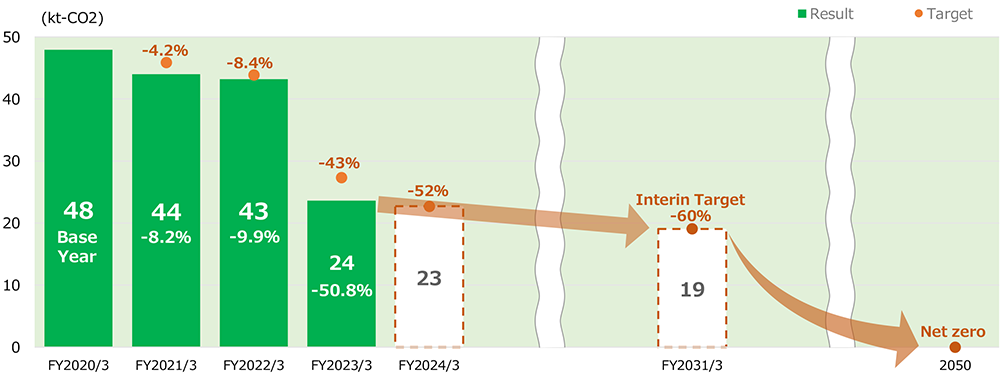

In our Medium-term Management Plan(FY2022/3-FY2026/3), we have set the KPI of a 60% reduction in the Bank’s CO2 emissions (Scopes 1 and 2) compared to FY2020/3 by FY2031/3. The reduction status is reported to the Executive Committee and the Board of Directors on a quarterly basis.

In FY2022, we achieved a 50.8% reduction compared to our 43% reduction target, partly due to the conversion of all company-owned facilities to renewable energy for electricity. As a short-term target, we have set a 52% reduction for FY2023 through efforts such as encouraging the conversion of our leased facilities to renewable energy and the conversion of our fleet of vehicles to EVs.

Change in GHG Emission Targets and Results

- Note 1:

- A level that is in line with the SBT's 1.5℃ level reduction target (4.2% or more reduction each year) and Japan's reduction target (goal of carbon neutrality by 2050, a 46% reduction compared to FY2014/3 by FY2031/3), which is also consistent with the Paris Agreement.

- Note 2:

- The targets cover 100% of the Scopes 1 and 2 emissions of JAPAN POST BANK (non-consolidated).

Related Information

Recent GHG Emissions Results and Targets

| Classification*1 | Base year | FY2022/3 | FY2023/3 | FY2024/3 | FY2031/3 Medium-term Target |

2050 Target |

||

|---|---|---|---|---|---|---|---|---|

| Target | Performance | Target | Performance | Target | ||||

| Emissions for the Bank (Scopes 1, 2) |

FY2020/3 (48kt-CO2) |

-8.4% (44kt-CO2) |

-9.9% (43kt-CO2) |

-43% (27kt-CO2) |

-50.8% (24kt-CO2) |

-52% (23kt-CO2) |

-60% (19kt-CO2) |

Net zero |

| Emissions from the finance portfolio (Scope 3 Category 15) |

- | - | Approx. 27 million t-CO2*2 | - | - | - | Power Generation Sector Emissions Intensity 165-213 gCO2e/kWh | |

- *1:

-

GHG Protocol classification. CO2 is a target and subject to management at JAPAN POST BANK.

Scope 1: Direct emissions of greenhouse gases by the business itself

Scope 2: Indirect emissions from the use of electricity, heat and steam supplied by other companies

Scope 3: Emissions of other companies related to the activities of the business (category 15: investment)

- *2:

- The GHG emissions of our investment and financing portfolio are calculated based on the Partnership for Carbon Accounting Financials (PCAF) methodology and according to our investment and finance balance as of March 31, 2022. Calculations are made using the GHG emission and financial-related data provided by S&P Global Trucost. (The GHG emissions data includes estimated values from S&P Global Trucost.) The scope of calculation includes shares and corporate bonds (Scopes 1 and 2) from Japan and overseas, however, in the event that there is not an established calculation method under the PCAF methodology or the data required for calculation is insufficient, they are excluded from the scope of calculation.

Measures for Mitigating and Adapting to Climate Change

To reduce the impact of climate change, we are working on measures for mitigating and adapting to climate change and are also supporting measures for the mitigation and adaptation to climate change within our supply chain and among our investees and borrowers. Details of these efforts are as follows.

| Climate change countermeasures | In-house initiatives | Supporting initiatives throughout the supply chain and among investees and borrowers |

|---|---|---|

|

Mitigation measures Measures that prevent global warming, such as by minimizing GHG emissions or maintaining and enhancing absorption by forests and plants |

(Scopes 1 and 2)

(Scope 3)

|

|

|

Adaptation measures Measures to address the current and future impact of climate change caused by global warming |

|

|

Promoting paperless business operations

JAPAN POST BANK is developing new services that will reduce paper usage by harnessing ICT, and we are eliminating paper and waste through the digitization of documents such as those that we send to our customers.

Internally, we are striving to reduce paper usage from various angles, accomplishing this by improving services through sales using tablets, as well as by eliminating paper used in internal meetings, introducing a paperless, electronic decision-making system, and conducting seminars through e-learning. All photocopy paper used internally is recycled paper.

Yucho Direct+ (plus) Non-Passbook General Account

With no issuing of a passbook, this service enables customers to use their cash cards for cash deposit and withdrawal enquiries, while current balances are obtained via "Yucho Direct." Instead of issuing passbooks, details of deposits and withdrawals can be confirmed for up to a maximum period of 20 years*. Since the paper used for both conventional passbooks and for the various notifications sent to customers is unnecessary, this leads to a reduction in paper usage.

- *:

- For deposits and withdrawals from March 2021. (Deposits and withdrawals made prior to March 2021 can be confirmed up to a maximum period of 15 months)

Related Information

Yucho Direct+ (plus) (Japanese version only)

Online Service for Viewing Transfer Receipt / Payment Notifications

This is a service that enables customers to check transfer receipt / payment notifications and payment handling slips from 9:00 a.m. the day after the account update on an office computer, home computer or smartphone. The feedback we have received from customers has included comments like "Being able to confirm transfer receipt / payment notifications via the internet is convenient," "No longer needing to store hard copies of transfer receipt / payment notifications has made life easier." Since transactions are confirmed via an online screen instead of informing customers in writing, this is also leading to a reduction in paper usage.

Related Information

Online Service for Viewing Transfer Receipt / Payment Notifications (Japanese version only)

Flat 35 S Home Loan that Supports the Purchase of Environmentally Friendly Homes

JAPAN POST BANK includes the Flat 35 S in its home loan lineup.

The Flat 35 S provides a reduced interest rate for a fixed period of time for Flat 35 applicants who acquire long-lasting homes that are high-quality, energy-saving, and earthquake-resilient.

By providing the FLAT 35 S to customers, JAPAN POST BANK will promote the spread of environmentally friendly housing, such as houses that reduce cooling and heating energy consumption, and work to contribute to Japan’s goal of achieving carbon neutrality by 2050.

In FY2022, we provided approximately 2.7 billion yen in [Flat 35] loans, of which approximately 1.8 billion yen was provided as [Flat 35] S loans.

Related Information

Yucho Flat 35 S (Japanese version only)

Environmental Consideration in Procurement (Climate Change and Biodiversity)

In our contract processes, we declare "Consideration for the environment: We shall conduct procurement activities with consideration for conservation of the global and regional environment and effective use of resources," and so conduct environmentally friendly procurement.

For example, we use vegetable-based ink*1 to print our Integrated Report (Annual Report) and Environmental Data Book. In addition, we check the materials used in the items we procure, and we are gradually changing item specifications to environmentally friendly materials.*2 We also continuously promote green purchasing.

Furthermore, in December 2018, we reviewed Japan Post Group's Approach to Procurement Activity (procurement policy). In addition to showing that the Japan Post Group supports the 10 principles in the four fields (human rights, labor, environment and anti-corruption) defined in the UN Global Compact, we ask our business partners for their cooperation.

- *1:

- Refers to ink made from recycled oil containing vegetable oil, such as soy oil and palm oil, and / or waste oil.

- *2:

- An initiative to reduce plastic waste.

Related Information

Japan Post Group's Approach to Procurement Activity (external website)

Japan Post Group's CSR Procurement Guidelines (external website)

For details on our ESG Investment and Financing initiatives and Social Contribution Activities for the Environment, please refer to Related Information.

Related Information

Social Contribution Activities for the Environment

Endorsing Environmental Policies

Endorsing COOL CHOICE

COOL CHOICE is a national movement being promoted by the Japanese Government that encourages people to make smart choices that assist measures to counter global warming, such as making lifestyle changes, replacing products, and using services that contribute to the creation of a carbon-free society. JAPAN POST BANK endorses COOL CHOICE.

Related Information

Investing in the Ministry of the Environment's Japan Green Investment Corp. for Carbon Neutrality

Participation in Industry Associations

JAPAN POST BANK is a member of the industry associations below.

We believe that the environmental policies of these industry associations are in accord with the policies of the Bank, however, should their policies deviate, we will clearly express our opinion in an effort to contribute to the promotion of climate change countermeasures throughout the entire industry.

- Japanese Bankers Association

- Japan Securities Dealers Association