Japan Post Bank continually conducts training and implements measures to spread understanding among management and employees, constantly promoting awareness to enable all employees to recognize the importance of business growth that is in harmony with society. From FY2023/3, along with bringing all employees together to raise their awareness toward solving social issues, we have implemented a specific initiative whereby all of our workplaces*1 throughout Japan formulate and achieve their own "SDGs declaration*2" to enable each individual employee to contribute to solving social issues through our business activities.

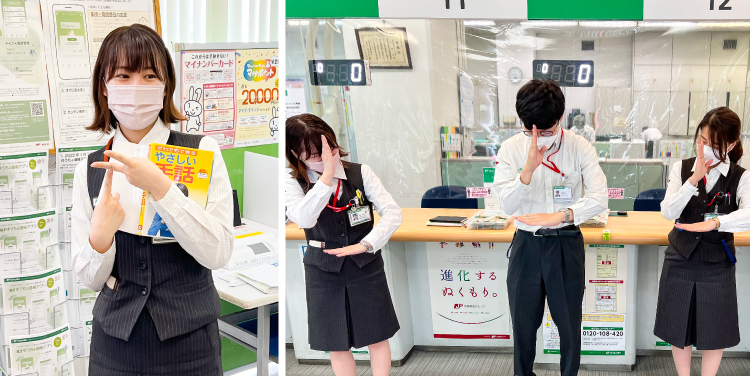

As representatives of the Bank's branches, we asked employees at Machida Branch, Tokyo, about their customer service initiatives in relation to the recent development of their SDGs declaration, and we spoke together about the purpose of Japan Post Bank.

- *1:

- In addition to its 233 national branches, Japan Post Bank has various other offices such as Regional Headquarters that manage its branches, Administration Service Centers that provide operational and sales support for branches and post offices, and Operation Support Centers that manage accounts and other areas.

- *2:

- Each workplace has declared an action plan with initiatives for achieving the SDGs after reflecting on Japan Post Bank’s priority issues (Materiality) and related SDGs.

Machida Branch’s SDGs declaration

Machida Branch's SDGs declaration

Happiness for Everyone

—Providing high-quality services to all customers equally!

Machida Branch's SDGs declaration expresses their purpose of "contributing to enriching the lives of customers while each and every employee feels rewarded in their work."

With the digitalization of banking advancing, we are always thinking of what we can do as a branch to maintain the relationships of trust that can only be built in-person and ensure the peace of mind that we have always provided for our customers continues to be there.

- Priority issues (Materiality) that Machida Branch is working toward

- Related SDGs

Participants:

The branch manager and three employees of Machida Branch, JAPAN POST BANK.

Interviewee H, Deputy Manager

Interviewee T, Deputy Manager

Your branch's SDGs declaration has a strong message, showing the positive attitudes of the employees and their desire to help customers.

How did you come to develop the declaration?

At our branch, we have customers of many different nationalities and ages. We strive everyday to address the various needs of all of our customers.

This year, we appointed our own "SDGs Leader" to greater promote our initiatives, selecting a Sales Department employee (Interviewee I) for the position. The SDGs Leader has run activities such as weekly study seminars, and our SDGs declaration was developed through discussion among employees under her leadership.

Recognizing the importance of a customer-oriented approach when carrying out our duties at the branch, we set initiatives related to the theme of "providing 'safe and secure' financial services to anyone and everyone throughout Japan," which is one of the Bank's priority issues (Materiality) that are based on the SDGs.

With war currently occurring in the world, we are painfully aware that not everyone is able to live their lives in peace. Japan Post Bank holds 120 million accounts, and we support Japan's infrastructure as a bank where most citizens of Japan are our customers. We believe that working to provide high-quality services to all customers equally is an effort we can make toward achieving the SDGs. This also expresses our intention to speak and act in a way that shows we care about all of our customers and fellow employees.

Please tell us about the things you are doing as a branch to realize your declaration, "Happiness for Everyone ."

We are making a range of efforts in our daily work to ensure that we provide high-quality services to all customers equally.

For example, since we communicate through writing with our hearing-impaired customers, we have made two writing devices (one for customer use and one for employee use) available and have created a corner in the branch for communicating through acrylic sheets to maintain social distancing due to the COVID-19 pandemic. In addition, all employees practice sign language every week at morning meetings so that we can provide a simple greeting.

Because we have customers of various different nationalities, we have instructions and explanatory materials available in each language, in addition to English, organized in a way that ensures we can quickly give them to customers. We also practice using POCKETALK (AI interpreting device) to ensure smooth communication.

In promoting these sorts of initiatives at your branch, how does each employee identify issues and put their ideas into practice?

After serving customers, we reflect on our service, considering whether our guidance may have been easier to understand if we had done things differently. In this way, we are always mindful of whether there are points for improvement. Our activities such as preparing documents in different languages in advance and learning sign language started as branch-wide initiatives based on the sharing of everyday observations among employees. By providing smoother service, we have increased customer satisfaction, and employees can feel rewarded in their work.

What each employee is being mindful of and working on to achieve the SDGs declaration

Please tell us about the things you are doing to achieve the SDGs declaration and what challenges have noticed.

As a teller, I try to ensure that I provide the same level of service to all customers.

While it does take more time serve foreign customers due to language barriers, seeing the delight on their faces when their requests have been properly fulfilled makes me feel a sense of value in my work. Recently, after opening a bank account for a foreign customer, they came back to our branch with their friend and introduced them to me. It felt great to hear they mentioned to their friend that "If you go to Japan Post Bank, they can open an account for you and explain everything clearly and politely." It was an occasion where I felt that my customer service was contributing to expanding the Bank's circle of customers.

In addition, as we have senior customers who have trouble hearing or need extra time to reach the teller windows, we are mindful to provide appropriate service that meets their needs. For example, for those who have difficulty hearing, we speak more loudly, slowly, and in a lower voice to ensure that they can hear properly. We are also mindful to collect information useful for customer service, sharing it among all employees.

I want to see all of our customers smile and be the person who makes customers say thank you. I strongly feel that this mindset also contributes to the achievement of the SDGs.

As a Sales employee, I provide information on asset-management products that suit our customers' life plans, such as investment trusts.

One thing I always make sure to do before explaining products to customers is ask what are the most important things to them, or who are the most important people. They might mention things like "My car is important to me because driving is my hobby," or "I have an adorable grandchild who has just been born." By listening to them, I can better understand who they are, their thinking, and their lifestyles, and therefore be able to inform them of products that are right for them.

As online consultations have increased recently, we are supporting customers through efforts such as helping those who require assistance in setting up their computers and explaining how to use our services online. I feel this also helps to expand the banking choices for customers who have trouble leaving their homes, enabling them to use Japan Post Bank more easily.

In addition, as I am the QQ Sales Leader*3 for Machida Branch, I strive to ensure that customer opinions are reflected in our service. I analyze the opinions of customers collected through surveys, considering what they would like to see and ways to improve our service.

- *3:

- "QQ" is an abbreviation for quantity and quality. QQ Sales Leaders were appointed at each branch in October 2018 with the aim of promoting customer-oriented business operations*4.

What measures should we take as a financial institution to be closer to our customers?

I think we need extensive knowledge and skills. So that our customers can use Japan Post Bank with peace of mind, it is important that we deepen our employees' knowledge as financial experts in areas such as pension and tax. At Machida Branch, Sales Department employees have the Financial Planner Level 2 certification (FP2), and constantly work to improve their knowledge. In the workplace, fellow employees diligently pursue their study at mini study seminars that are held every week.

I also think that it is important to look properly at our customers and understand their different situations.

While we are always being mindful to prevent bank transfer scams at our teller windows, recently, an employee who felt that a customer's actions and transaction details were suspicious successfully prevented an incident of bank transfer fraud. I believe that the practice of looking properly at each customer to understand what their current situation is and provide closer service leads to the protection of customers.

- *4:

-

Customer-oriented business operations of Japan Post Bank

In order to actively respond to the diverse needs of our customers through services such as asset building support and our existing deposit and remittance services, Japan Post Bank adopted the "Principles for Customer-oriented Business Conduct" that were announced by the Financial Service Agency of Japan in March 2017, and in June of the same year we established our "Basic Policy for Fiduciary Duties." We also disclose details of our initiatives concerning our customer-oriented business operations and the status of these initiatives on our website. We sincerely listen to the opinions of our customers and thoroughly conduct customer-oriented business operations, aiming to be a truly trustworthy bank.

| Main initiatives at branches | ||

|---|---|---|

| Providing customer-oriented information and consulting services | System for understanding customer feedback |

We verify whether the products we propose and our sales and recommendation methods are appropriate for our customers, receiving their evaluations through means such as surveys. We also disseminate information regarding market conditions and the profit and loss status of the financial products we hold. Furthermore, should our customers' life plans change, we make proposals for our customers' new life plans tailored to their needs, and offer support including helping them to make the right investment decisions. |

| Life plan consulting |

With lifestyles currently diversifying, we make proposals that suit the life plans of each customer through means such as using our Life Plan Consulting (LPC) app to run various simulations. |

|

| Improving the system for managing conflict of interest | Appropriate management of conflict of interest transactions |

We propose asset-management products that we believe meet the needs of our customers, irrespective of the amount of sales commissions related to the product or sales channel. |

| Fostering human resources / Performance evaluations | Training system |

We carry out training to provide knowledge on topics such as products and services or superannuation and inheritance. We also conduct role playing exercises for consulting proposals and training to ensure proper work practices. In addition, we support our employees in gaining qualifications to develop their expertise. We ascertain whether each employee has the skills required for consulting work, and branch managers guide employees after creating a skills development plan for each of them. Branch managers also regularly follow up on each employee in accordance with their progress in acquiring the skills outlined in development plan. |

What Japan Post Bank can do to achieve the SDGs

As branch manager, what do you feel your role is and what are you enthusiastic about in regard to achieving the SDGs?

The purpose of Japan Post Bank is to "We aim for the happiness of customers and employees and will contribute to the development of society and the region." For the Machida Branch, this means "contributing to enriching the lives of customers while each and every employee feels rewarded in their work." Our SDGs declaration expresses this ideal. With the digitalization of banking advancing, we are always thinking of what we can do as a branch to maintain the relationships of trust that can only be built in-person and ensure the peace of mind that we have always provided for our customers continues to be there.

Before I was appointed as branch manager, I worked in the investment trusts business department at our head office and was involved in sales strategy formulation and plan design for asset-management products. With the number of people using their smartphones to manage their assets by themselves increasing, what are Japan Post Bank's advantages? While there are customers who want to manage their assets by themselves easily using an app, there are also customers who want someone to politely explain everything until they understand. To meet the needs of both of these types of customers, Japan Post Bankis working to develop its digital channel, while also providing attentive consulting to customers at our branches at the same time. We have appointed a QQ Sales Leader at each branch who analyzes opinions or complaints that have been received when serving customers, taking them into account to improve our service. Through this, we are working to increase customer satisfaction, engaging in customer-oriented business operations.

The mission of our physical channel throughout Japan is to ensure that customers know that if they do their banking with Japan Post Bank, employees will consult with them directly and will kindly and politely provide suggestions and explanations. I feel that my role as branch manager is to work together with branch employees to achieve this.

Comment from Kishi, Executive General Manager of the Tokyo Regional Headquarters

The Tokyo Regional Headquarters supports all post offices and directly operated branches in Tokyo on a daily basis to ensure that they are loved by their customers.

All employees at the Machida Branch strive to improve their daily service through efforts such as helping senior customers who require assistance in setting up online banking and by improving their skills at making sure facilities are in place to enable those with disabilities to easily use the Bank's services. The branch has also commented that it is important to look at customers properly and provide service that meets their needs so that they can trust Japan Post Bank and have peace of mind. I feel that this reflects the stance and intention of the Bank to fulfill our customers' expectations.

To contribute to achieving the SDGs, we will value customer opinions, engaging in customer-oriented business operations together with our post offices and directly operated branches.

Comment from the Corporate Planning Department Sustainability Management Office

The Corporate Planning Department Sustainability Management Office constantly implements measures to promote understanding of ESG and the SDGs so that each of Japan Post Bank's employees can fully understand the importance of sustainability and strive toward solving social issues such as the SDGs through our business activities.

By developing SDGs declarations at each workplace and putting them into practice, employees can recognize the Bank's purpose, their individual purpose, such as their life goals and meaning of their work, and the challenges of each workplace, which will in turn lead to a greater contribution to the achievement of the SDGs.

Job titles are as of June 2022