Corporate Governance System

- System Overview

- Board of Directors

- Support system for Outside Members of the Board of Directors

- Succession plan

- Elections and Dismissals of Executive Officers, Nominations of Director Candidates

- Policy for Determining Amount or Calculation Method of Compensation, etc., for Directors and Executive Officers

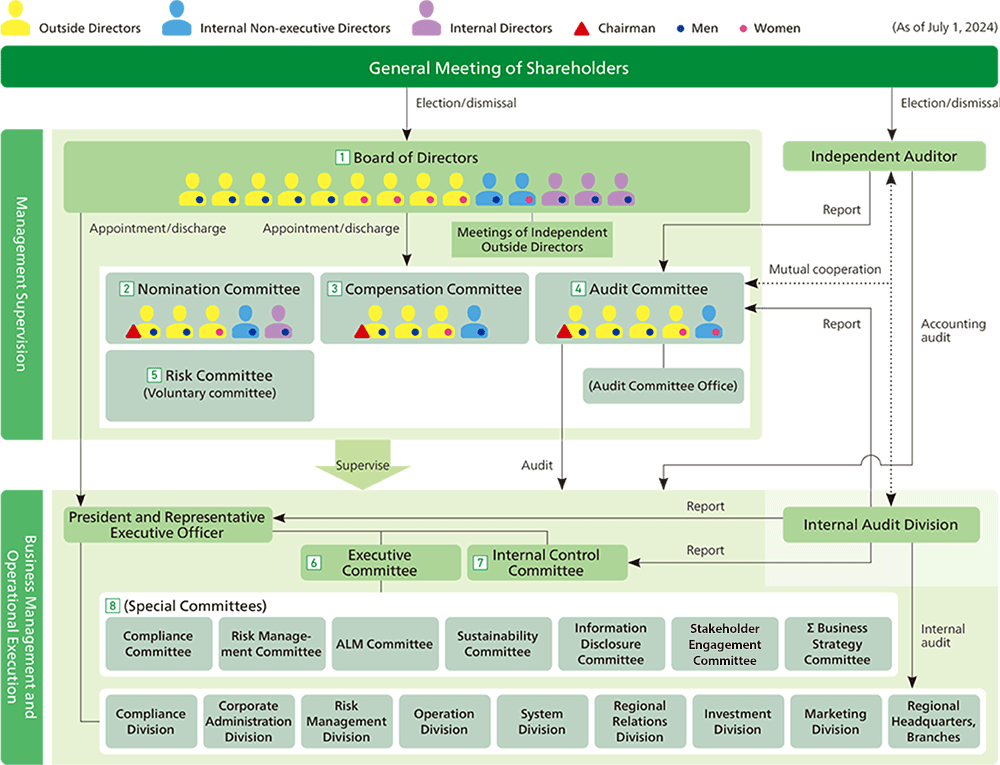

System Overview

JAPAN POST BANK adopted the company with three statutory committees system of corporate governance to implement rapid decision-making and to increase management transparency. This is deemed to be a system under which the Board of Directors and each statutory and voluntarily established committee can provide appropriate oversight of management.

Supervisory Function

As of July 1, 2025

| Roles and composition (as of July 1, 2025) | Main agenda and operational status (FY2024) | Number of meetings (FY2024) |

|

|---|---|---|---|

|

|

The Board of Directors consists of 14 Members of the Directors (five women and nine men), 9 of whom are Outside Members of the Board of Directors. Members of the Board of Directors is responsible for supervising management, drawing on the diverse experience and knowledge of its Members. | In FY2024, the Board of Directors discussed important management strategy issues, including the formulation of the annual management plan, revision of the Medium-term Management Plan, compliance systems, human capital strategy, and capital policy, such as the offering of the Bank’s common stock held by Japan Post Holdings Co., Ltd., and the repurchase and cancellation of the Bank’s shares. The Board also discussed the improper use of non-public financial information at post offices. In addition, the Board of Directors exercised appropriate supervision over business execution from the perspective of ensuring the proper conduct of business. | 13 |

|

|

The Nomination Committee consists of five Members of the Board of Directors (including three Outside Members of the Board of Directors) and determines the criteria for the appointment and dismissal of Members of the Board of Directors. It also determines the content of proposals to be submitted to the Shareholders’ Meeting regarding the appointment or dismissal of Members of the Board of Directors. | In FY2024, we decided on candidates for Members of the Board of Directors and held ongoing discussions on the appointment of candidates for the next term of office. We also held ongoing discussions on the succession plan for the President & CEO. | 7 |

|

|

The Compensation Committee, consisting of four Members of the Board of Directors (including three Outside Members of the Board of Directors), determines the policy on the compensation of Executive Officers and Members of the Board of Directors. It also determines the compensation of Executive Officers and individual Members of the Board of Directors. | In FY2024, we determined the individual compensation for Executive Officers and Members of the Board of Directors, as well as the performance-based compensation for Executive Officers. We also discussed the level of compensation for officers. | 6 |

|

|

The Audit Committee, consisting of five Members of the Board of Directors (including four Outside Members of the Board of Directors), audits the execution of duties by Executive Officers and the Members of the Board of Directors and prepares audit reports. It also determines the content of proposals to be submitted to the Shareholders’ Meeting regarding the appointment and dismissal of Independent Auditors and the non-reelection of Independent Auditors. | In FY2024, we focused our audits on improving internal control systems and initiatives to maintain and develop our business. In response to cases of inappropriate use of non-public financial information at post offices, we are working with other Group companies to strengthen the management and supervision system of Japan Post Co., Ltd., to prevent recurrence, and are closely monitoring the status of initiatives to improve internal control systems, including the prevention of internal crimes. | 14 |

|

(Voluntary committee) |

Comprising three Members of the Board of Directors (including two Outside Members of the Board of Directors) and two external experts, the Risk Committee is an advisory body to the Board of Directors. It deliberates on important matters related to risk management. | In FY2024, we deliberated on market and ALM-related matters and IT system–related matters based on the risk characteristics of Japan Post Bank. We deliberated on the investment plan and the results of its review, the cybersecurity posture, and the status of system renewal, and reported to or advised the Board of Directors on important matters. | 6 |

| Role | |

|---|---|

| Meetings of Independent Outside Members of the Board of Directors |

The purpose of this meeting is for Independent Outside Members of the Board of Directors to exchange information and share their views on important issues related to the management and governance of Japan Post Bank from an independent and objective standpoint. All Outside Members of the Board of Directors of Japan Post Bank are designated as independent officers as defined by the Tokyo Stock Exchange. |

Business Management and Operational Execution

| Role | ||

|---|---|---|

|

|

The Executive Committee has been established as an advisory body to the President & CEO, Representative Executive Officer, to hold discussions on important business execution matters. | |

|

|

The Internal Control Committee has been established as an advisory body to the President & CEO, Representative Executive Officer, to hold discussions on legal, regulatory, and other compliance-related issues, as well as other important internal control matters. | |

|

|

The Special Committees assist the Executive Committee in matters requiring specialized discussions. | |

| Compliance Committee | The Compliance Committee formulates compliance systems and programs and holds discussions and provides reports regarding progress in these matters. | |

| Risk Management Committee | The Risk Management Committee formulates risk management systems and operational policies. The committee also holds discussions and provides reports regarding progress in risk management matters. | |

| ALM Committee | The ALM Committee formulates basic ALM plans and operational policies, determines management items, and holds discussions and provides reports regarding progress in these matters. | |

| Sustainability Committee | The Sustainability Committee formulates action plans with regard to sustainability and holds discussions and provides reports regarding progress in these matters. | |

| Information Disclosure Committee | The Information Disclosure Committee formulates basic information disclosure policies, holds discussions, and provides reports on disclosure content and progress in order to ensure the appropriateness and effectiveness of information disclosure. | |

| Stakeholder Engagement Committee | This committee discusses and reports on the content of the policy and the formulation of plans relating to customer-oriented business operations based on "customer feedback" and "employee feedback," and other important items including the status of implementation. | |

| Σ Business Strategy Committee | This committee deliberates and reports on the formulation and progress of strategies and plans for the Σ Business, which is a corporate business for creating the future for society and local communities through investment. | |

Features of JAPAN POST BANK Corporate Governance (As of July 1, 2025)

![[Ratio of outside directors] Outside directors 9/14, Outside directors 64.2% [Ratio of Men to Women] Women 5/14, Women 35.7%](/en/sustainability/governance/system/images/index_img_02.svg)

Board of Directors

Skills Matrix

The Board of Directors is comprised of directors with diverse experience and knowledge.

As of July 1, 2025

| Name | Experience and expertise | Committee staffing status | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Management (Corporate Management) |

Legal, Compliance, and Risk Management | Finance and Accounting |

Finance and Market Operations |

IT/DX | Sales/ Marketing |

Human Resource Development | Sustainability | Nomination Committee | Compensation Committee | Audit Committee | Risk Committee (Voluntary Committee) |

|||

| Outside Members of the Board of Directors |  |

Makoto Kaiwa | ● | ● | ● | ★ | ||||||||

|

Hiroshi Kawamura | ● | ★ | |||||||||||

|

Kenzo Yamamoto | ● | ● | ● | ★ | |||||||||

|

Keiji Nakazawa | ● | ● | ● | ● | ● | ● | |||||||

|

Atsuko Sato | ● | ● | ● | ● | ● | ||||||||

|

Reiko Amano | ● | ● | ★ | ||||||||||

|

Akane Kato | ● | ● | ● | ● | |||||||||

|

Shigeki Mori | ● | ● | ● | ● | ● | ● | |||||||

|

Junko Moro | ● | ● | ● | ● | |||||||||

| Internal Members of the non-executive Board of Directors |  |

Kazuyuki Negishi | ● | ● | ● | ● | ● | ● | ||||||

|

Miho Ichiki | ● | ● | ● | ● | ● | ||||||||

| Internal Members of the Board of Directors |  |

Takayuki Kasama | ● | ● | ● | ● | ● | |||||||

|

Harumi Yano | ● | ● | ● | ● | |||||||||

|

Kenji Ogata | ● | ● | ● | ● | |||||||||

| External Experts | Takao Yajima | Chairman of specified non-profit organization CIO Lounge | ● | ||

| Hiromi Yamaoka | Board Director of Future Corporation, Director Group CSO & CLO | ● |

- Note: ★indicates chairperson

Reasons for the Nomination as Candidate for Director

| Position | Name | Reason |

|---|---|---|

| President and Representative Executive Officer | Takayuki Kasama | Mr. Takayuki Kasama was appointed as an executive officer, as he has successively held various important posts in the Investment Division and other departments of the Bank, and has been responsible for the management as President and Representative Executive Officer of the Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations by making use of his abundant experience and track record of achievements. |

| Representative Executive Vice President | Harumi Yano | Mr. Harumi Yano was appointed as an executive officer, as he has successively held various important posts in the Corporate Administration Division and other departments of the Bank, and has been responsible for the management as Representative Executive Vice President of the Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations by making use of his abundant experience and track record of achievements. |

| Representative Executive Vice President | Kenji Ogata | Mr. Kenji Ogata was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Compliance Division and other departments of Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Senior Managing Executive Officer | Masato Tamaki | Mr. Masato Tamaki was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Risk Management Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Senior Managing Executive Officer | Hisashi Matsunaga | Mr. Hisashi Matsunaga was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the System Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Senior Managing Executive Officer | Makoto Shinmura | Mr. Makoto Shinmura was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing ExecutiveOfficer | Shinobu Nagura | Mr. Shinobu Nagura was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Satoru Ogata | Mr. Satoru Ogata was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the System Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Hideki Nakao | Mr. Hideki Nakao was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Investment Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Koji Iimura | Mr. Koji Iimura was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Internal Audit Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Etsuko Kishi | Ms. Etsuko Kishi was appointed as an executive officer, as she has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on her experience in the Marketing Division and other positions at Japan Post Bank. She is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Akihiro Den | Mr. Akihiro Den was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Operation Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Koji Hasukawa | Mr. Koji Hasukawa was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the ALM Planning Department in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Managing Executive Officer | Yuko Yoshida | Ms. Yuko Yoshida was appointed as an executive officer, as she has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on her experience in the Investment Division and other positions at Japan Post Bank. She is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Ryotaro Yamada | Mr. Ryotaro Yamada was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the General Affairs Department in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Masaya Touma | Mr. Masaya Touma was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as Chief Director of South Kanto Regional Headquarters and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Katsuya Fukushima | Mr. Katsuya Fukushima was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the Corporate Planning Department in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Koichiro Yoshida | Mr. Koichiro Yoshida was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as Chief Director of Tokyo Regional Headquarters and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Hisanori Kato | Mr. Hisanori Kato was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the Compliance Management Department in the Compliance Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Yasumitsu Toyoda | Mr. Yasumitsu Toyoda was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Investment Business Promotion Department of the Regional Relations Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Junko Fujie | Ms. Junko Fujie was appointed as an executive officer, as she has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on her experience in the Customer Satisfaction Department of the Corporate Administration Division and other positions at Japan Post Bank. She is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Hiroshi Ueda | Mr. Hiroshi Ueda was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the Marketing Department in the Marketing Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Kenji Aono | Mr. Kenji Aono was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience in the Regional Relations Management Department and the Regional Revitalization and New-Growth Business Development Department of the Regional Relations Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Hirokazu Yamamoto | Mr. Hirokazu Yamamoto was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the Human Resources Department and the Diversity and Inclusion Department in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Tomotake Yano | Mr. Tomotake Yano was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the Digital Strategy Department and the Digital Service Business Department in the Marketing Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

| Executive Officer | Kenichi Imai | Mr. Kenichi Imai was appointed as an executive officer, as he has the knowledge and experience to be able to execute the Bank's operations appropriately, fairly and efficiently, based on his experience as General Manager of the Investor Relations Department in the Corporate Administration Division and other positions at Japan Post Bank. He is therefore expected to play an adequate role in deciding the business execution of the Bank and executing its business operations. |

Independent Director Appointment Standards

Japan Post Bank shall appoint Independent Directors stipulated by the Tokyo Stock Exchange from Outside Directors who do not fall under any of the following.

- Those who have served as an Executive of the Japan Post Group in the past.

- Those who have served as a Director who is not an Executive of the parent company of Japan Post Bank in the past.

- Entities which hold Japan Post Bank as major client or an Executive thereof, etc.

- Entities which are major clients of Japan Post Bank or an Executive thereof, etc.

- Consultant, accounting expert or legal expert who acquire, or have acquired substantial money or other property from Japan Post Bank other than officers’ compensation (in case of an organization including corporation, association, etc., those who are, or have been affiliated to such organization in the past)

- Major shareholder of Japan Post Bank (in case of a corporation, an Executive thereof, etc.)

- Spouse or relative within the second degree of kinship of the following (excluding those without significance).

(1) Those listed in 1 to 6 above

(2) Executive of the Japan Post Group (excluding Japan Post Bank)

(3) Director who is not an Executive of the parent company of Japan Post Bank - Those who execute business in a company in which those who execute business, etc. of Japan Post Bank serve as outside officer.

- Those who receive a substantial amount of donation from Japan Post Bank (in case of an organization including corporation, association, etc., those who execute business, etc. thereof, or similar)

Appendix

- The definitions of the terms in these Standards are as follows.

Japan Post Group Japan Post Bank, its parent company, subsidiaries and fellow subsidiaries of the parent company Executive An executive stipulated in Article 2, Paragraph 3, Item 6 of the Ordinances for the Enforcement of the Companies Act Executive, etc. An Executive or those who have been an Executive in the past Entities which hold Japan Post Bank as major client An entity which the average annual cash amount paid from Japan Post Bank thereto in the past three fiscal years is over 2% of annual average consolidated total net sales thereof in the past three fiscal years Entities which are major clients of Japan Post Bank An entity which the average annual cash amount paid therefrom to Japan Post Bank in the past three fiscal years is over 2% of annual average consolidated ordinary income of Japan Post Bank in the past three fiscal years Substantial money Individuals: An average annual cash amount of over ¥10 million in the past three fiscal years

Organizations: The average annual cash amount paid from Japan Post Bank to such entity in the past three fiscal years which is over 2% of annual average consolidated total net sales of such entity in the past three fiscal yearsMajor shareholders Major shareholders stipulated in Article 163, Paragraph 1 of the Financial Instruments and Exchange Act Substantial amount of donation An average annual donation of over ¥10 million in the past three fiscal years - In case transactions or donations relating to the independent directors satisfy the following standards of immateriality, statement on the attribute information of independent directors will be omitted on the judgment that there are no effects on the independence of such independent directors.

(1) Transactions

- 1) The average annual amount paid from Japan Post Bank to such entity in the past three fiscal years is less than 1% of annual average consolidated total net sales of such entity in the past three fiscal years

- 2) The average annual amount paid from such entity to Japan Post Bank in the past three fiscal years is less than 1% of annual average consolidated ordinary income of Japan Post Bank in the past three fiscal years

An annual average donation from Japan Post Bank is less than ¥5 million in the past three fiscal years

Support system for Outside Members of the Board of Directors

To ensure the effective and smooth operation of the Board of Directors, and to enhance the effectiveness of supervision by Outside Members of the Board of Directors, the following measures are taken with respect to the Board of Directors. In addition, the Board of Directors’ Office has been established and appropriately staffed to provide operational support for the effective and efficient conduct of Board of Directors’ meetings and to facilitate communication and coordination with Outside Member of the Board of Directors.

- Coordination of an annual schedule with sufficient time available

- Timely and appropriate provision of information as necessary

- Ensuring sufficient prior explanation and time for prior consideration of the content of agenda items

- Ensuring time for questions at Board of Directors’ meetings

Provision of information to Outside Members of the Board of Directors

1. Implementation of training and study sessions

We provide training to executives, including Outside Members of the Board of Directors, to deepen their understanding of Japan Post Bank’s business, challenges, management strategies, and other matters, and to acquire the knowledge necessary to fulfill their expected roles and responsibilities.

In addition, we hold study sessions on Japan Post Bank’s operations for Independent Outside Members of the Board of Directors at the Meetings of Independent Outside Members of the Board of Directors and other opportunities to support them in supervising Japan Post Bank’s management more effectively.

Main Training Topics

| Topics | Training and related content |

|---|---|

| Shareholders' Meeting, Investor Relations | Conducted training sessions by attorneys on points for executives to note when speaking at shareholder meetings, as well as study sessions led by external lecturers on IR activities, management strategy, and other topics. |

| Media Relations | Conducted training with outside experts as instructors to deepen understanding of crisis management public relations in light of recent risk trends. |

| Cybersecurity | Training by external instructors on cyber security measures and incident response from the perspective of raising awareness of the risks of cyber attacks, etc. |

| Anti-Money Laundering, Terrorist Financing, and Proliferation Finance | Conducted training by external instructors as part of the development of a risk management system for money laundering, etc. |

| International Financial Regulations Related to Risk Management | Conducted study sessions on capital adequacy regulations, Basel III finalization, etc. |

| Operational Resilience | To promote understanding of operational resilience (hereafter referred to as "OpRes"), we conducted training led by an external instructor covering the background and purpose behind the requirement for OpRes, as well as the approach to OpRes within our bank. |

In addition, the Bank strives to enhance support for directors. For example, we provide new Outside Members of the Board of Directors with opportunities for individual explanations of the Bank's operations (management plans, market operations, risk management, compliance, etc.) .

Also, the Risk Committee, which invites outside experts as committee members, is open to the Members of the Board of Directors who are not committee members, so that audit committee members and the other Members of the Board of Directors attend the committee.

2. Visits to business sites

The Outside Members of the Board Directors conduct visits to Japan Post Bank facilities with the aim of deepening participants’ understanding of our business and providing them with a more concrete and practical perspective.

FY2024, they visited several areas and observed the automation and digitization of operations at directly operated branches and post office counters, as well as the use of generative AI at Operation Support Centers, which provide sales and administrative support to post offices.

They also exchanged opinions with employees on the ground about actual business operations and challenges.

Succession plan

At JAPAN POST BANK, the Nomination Committee deliberates on succession plans for executives, including the President and Representative Executive Officer, with the aim of achieving sustainable corporate growth and enhancing corporate value over the medium to long term. The Nomination Committee clarifies the ideal image of the President and Representative Executive Officer in terms of values, qualities, and abilities based on JAPAN POST BANK’s vision. The Nomination Committee then establishes objective evaluation criteria and holds discussions based on them, referring to individual and multifaceted evaluations by external organizations. In addition, we are working to develop human resources based on evaluation criteria for the ideal President and Representative Executive Officer in order to facilitate succession planning.

Elections and Dismissals of Executive Officers, Nominations of Director Candidates

With regard to the policies and procedures for electing or dismissing executive officers and nominating director candidates, the Bank has established the "Criteria for Election or Dismissal of Executive Officers" and the "Criteria for Nomination of Director Candidates."

Related Information

Criteria for Election or Dismissal of Executive Officers (PDF/46KB)

Compensation for Directors and Executive Officer

Policy on Determining Remuneration Amounts for Directors and Executive Officers, and the Calculation Methods Thereof

In regard to compensation for the Bank’s directors and executive officers, the Compensation Committee has prescribed the policy for determining the details of individual compensation for directors and executive officers as follows, and it determines the amount of compensation in accordance with this policy.

At the Compensation Committee meeting held on June 18, 2024, the Committee resolved to revise the compensation system for directors and executive officers along with this policy.

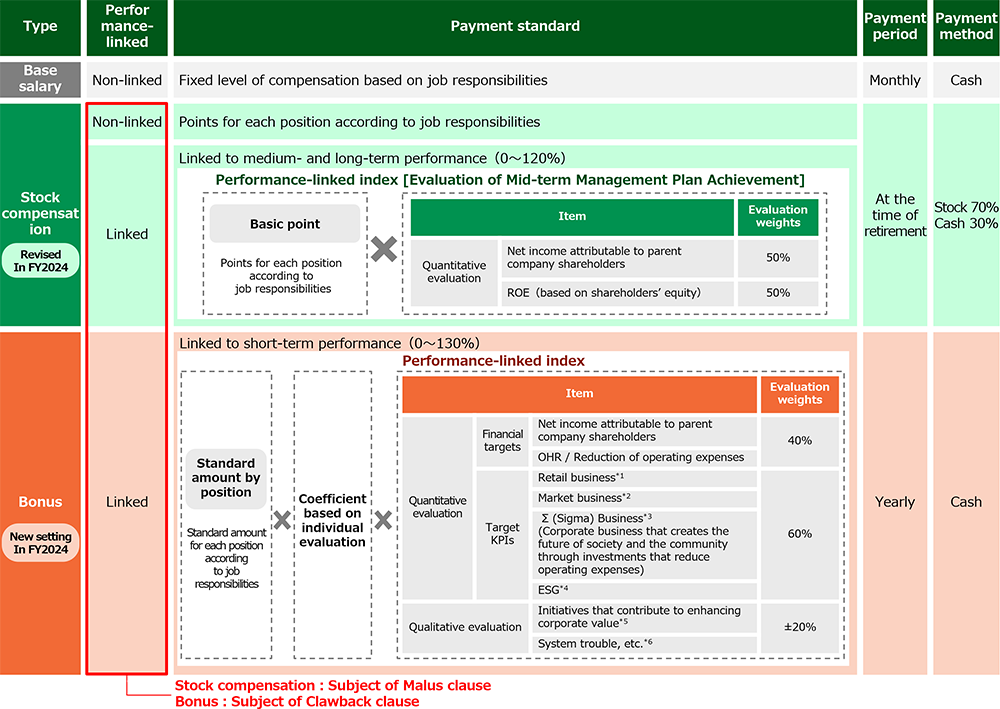

1. Compensation system

- When serving concurrently as a director and executive officer, compensation shall be paid for the position of executive officer.

- Compensation that directors of the Bank receive shall be paid in the form of a fixed amount of compensation corresponding to duties, in light of the scope and scale of responsibility relating to management, and the like.

- Compensation that executive officers of the Bank receive shall be paid in the form of a base salary (a fixed amount of compensation), a short-term incentive in the form of a bonus, and a mid-to-long-term incentive in the form of stock compensation (both non-performance-linked and performance-linked), and shall function as a sound incentive for the achievement of performance goals and sustainable growth.

2. Compensation for directors

Compensation for directors shall be paid as a certain level of a fixed amount of compensation corresponding to duties, in light of the main role of supervision of management, and the level shall be an appropriate one that takes into account the scale of duties as a director, the role in each committee, and the current situation of the Bank.

3. Compensation for executive officers

Compensation for executive officers shall be paid in the form of a certain level of base salary (a fixed amount of compensation), in light of differences in responsibility that varies according to the job position, a short-term incentive in the form of a bonus, and a mid-to-long-term incentive in the form of stock compensation (both non-performance-linked and performance-linked).

The level of base salary shall be an appropriate one that takes into account the scale of duties of the executive officer and the current situation of the Bank.

The bonus shall function as an incentive to steadily achieve the performance targets for a single fiscal year. It shall be calculated by multiplying the standard amount according to the responsibilities by a coefficient based on the individual evaluation and a coefficient that varies according to the achievement status of the management plan, and the cash will be paid every year.

In regard to stock compensation, based on the viewpoint of a sound incentive for improving mid- to long-term corporate value and sustainable growth, a fixed amount of points according to the responsibilities shall be granted every year, and points that are calculated by multiplying the sum of basic points corresponding to duties by a coefficient that varies according to the state of achievement of the management plan shall be granted after the end of the final fiscal year of the medium-term management plan, and shares corresponding to the points accumulated at the time of retirement from office shall be provided. However, a certain percentage of this shall be paid in the form of money obtained by converting the shares into cash.

Furthermore, in the case of a person who is an executive officer in charge of an area that requires special knowledge and skills and, based on the compensation corresponding to his/her duties, would receive a significantly lower level of compensation than what an officer in charge of such an area would generally receive at other companies, it shall be permitted to adopt compensation that refers to the level of compensation at other companies instead of compensation corresponding to duties.

- *1:

- Evaluation based on number of accounts registered in the Yucho Bankbook app, number of Tsumitate NISA operation accounts.

- *2:

- Evaluation based on balance of risk assets, balance of strategic investment areas, RORA(Return on Risk-Weighted Assets).

- *3:

- Evaluation based on domestic General Partner(GP)-related investment commitments.

- *4:

-

Evaluation based on balance of ESG-themed investments and financings, ESG ratings from major ESG rating agencies(FTSE, MSCI, CDP, DJSI), ratio of women in managerial positions, ratio of employees with disabilities, childcare leave rate for male employees(more than 4 weeks), evaluation based on employee engagement index.

ESG’s valuation weighting in the short-term performance linkage is 15%.

ESG-related indicators are applied to all executive officers, including the President and Representative Executive Officer. - *5:

- Only particularly noteworthy initiatives that enhance corporate value, such as customer-oriented business operations, Advancing DX, and human capital management, will be added.

- *6:

- Points are deducted based on system trouble, noncompliance status, etc.

ESG Indicators Climate change Evaluation weight Balance of ESG-themed investments and financing ○ 3% Ratings by major ESG rating agencies (FTSE, MSCI, CDP, DJSI) ○ 3% Rate of female managerial positions 3% Rate of employees with disabilities 2% Rate of male employees taking childcare leave (four weeks or more) 2% Employee engagement indicators 2% Total 15% - Note:

- Climate change–related indicators are "balance of ESG-themed investments and financing" and "ratings from major ESG rating agencies."

The balance of ESG-themed investments and financing is a target for the balance of investments and financing in ESG bonds and other instruments for which the use of proceeds is for climate change mitigation and adaptation.

Ratings from major ESG rating agencies include climate change–related ratings and provide an objective assessment of Japan Post Bank’s climate change initiatives.

Incorporation of ESG evaluation items into executive compensation

In promoting overall management and the operations of each division, from the viewpoint of providing sound incentives not only from the short-term perspective of single fiscal year performance, etc., but also for efforts toward the Bank's long-term, sustainable growth, from FY2021, the Bank will reflect the status of promotion of sustainability management in the compensation of executive officers.The evaluation items will be reviewed each fiscal year as necessary in response to changes in the external environment and the Bank's internal environment.

Number of persons compensated, compensation, etc., for each officer category (FY2024)

(Millions of yen)

| Category | Number of recipients |

Compensation, etc. |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| Basic compensation |

Stock compensation | Bonuses | Retirement gratuity |

Other | |||||

| Non-performance- linked |

Performance- based |

Performance- based |

|||||||

| Members of the Board of Directors |

10 | 149 | 149 | - | - | - | - | 0 | |

| Executive Officers |

29 | 1,096 | 645 | 76 | 188 | 183 | - | 2 | |

| Total | 39 | 1,245 | 794 | 76 | 188 | 183 | - | 2 | |

- Notes:

-

1.Amounts are rounded down to the nearest unit.

2.Compensation for Members of the Board of Directors who also serve as Executive Officers is not included in the compensation for executive officers.

3.The number of Members of the Board of Directors does not include one Member of the Board of Directors who does not receive compensation.

4.Compensation for three Executive Officers who retired during the current fiscal year is included.

5.Performance-linked stock compensation and bonuses are recorded at the amount expensed during the current fiscal year.

6.The retirement benefits program for Executive Officers was abolished in June 2013, but retirement benefits for the period of service prior to the abolition of the program will be paid to Executive Officers who remain in office at the time of retirement.