Risk Management

Basic Stance

We place a high priority on risk management and are taking steps to refine our sophisticated framework for risk management, including the identification and control of the risks associated with our operational activities.

Our basic policy is to appropriately manage risks in view of our management strategies and risk characteristics and most effectively utilize our capital. By doing so, we are able to increase enterprise value while maintaining sound finances and appropriate operations.

Risk Categories and Definitions

We define our risks and classify them into the following categories, and manage these risks based on the unique characteristics of each type of risk.

| Risk Category | Risk Definition |

|---|---|

| Market risk | Market risk is the risk of loss resulting from changes in the value of assets and liabilities (including off-balance sheet assets and liabilities) due to fluctuations in risk factors such as interest rates, foreign exchange rates and stock prices and the risk of loss resulting from changes in earnings generated from assets and liabilities. |

| Market liquidity risk | Market liquidity risk is the risk that a financial institution will incur losses because it is unable to conduct market transactions or is forced to conduct transactions at far more unfavorable prices than under normal conditions due to a market crisis and the like. |

| Funding liquidity risk | Funding liquidity risk is the risk that a financial institution will incur losses because it finds it difficult to secure the necessary funds or is forced to obtain funds at far higher interest rates than under normal conditions due to a mismatch between the maturities of assets and liabilities or an unexpected outflow of funds. |

| Credit risk | Credit risk is the risk that a financial institution will incur losses from the decline or elimination of the value of assets (including off-balance sheet assets) due to deterioration in the financial condition of an entity to which credit is provided. |

| Operational risk | Operational risk is the risk of loss resulting from inadequate operation processes, inadequate activities by officers and employees and inadequate systems or from external events. |

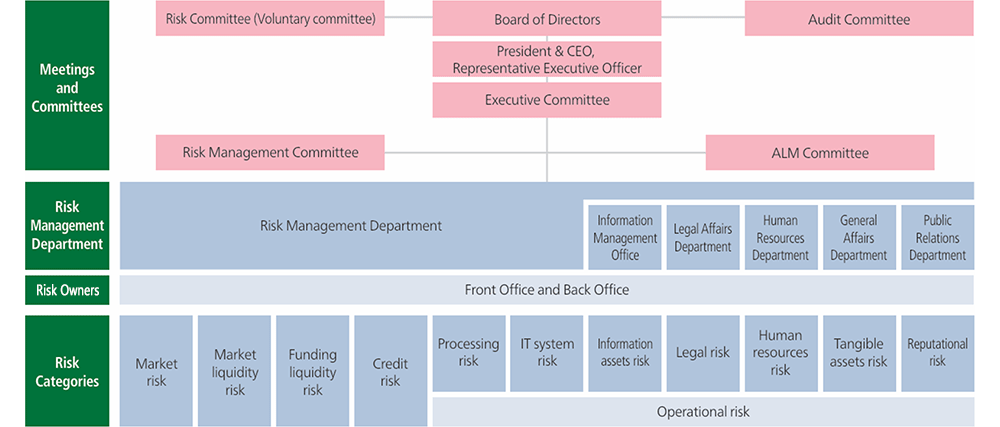

Risk Management System

The Bank has identified certain risk categories outlined in the table below. At JAPAN POST BANK, in managing risks, Front Office and Back Office divisions act as risk owners. To ensure effective management of each risk category, we have established dedicated departments responsible for managing individual risk categories. In addition, to ensure the effectiveness of integrated risk management across the entire organization, we have established a Risk Management Department that oversees all risk categories in an integrated manner. This department operates independently from other business units.

We have established special advisory committees to the Executive Committee to handle risk management responsibilities:the Risk Management Committee and the ALM Committee.These advisory committees submit risk management reports based on risk characteristics and hold discussions about risk management policies and systems.

Meanwhile, officers in charge of the Risk Management sections also report on such matters as the status of risk management to the Board of Directors, the Audit Committee and the Risk Committee on a periodic and as-needed basis.

Prior to launching new products, services, or businesses, we assess potential risks and select appropriate methods to measure risks.

Risk Management System (As of July 1, 2025)

Integrated risk management

Japan Post Bank manages risks in five categories using both quantitative and qualitative methods.

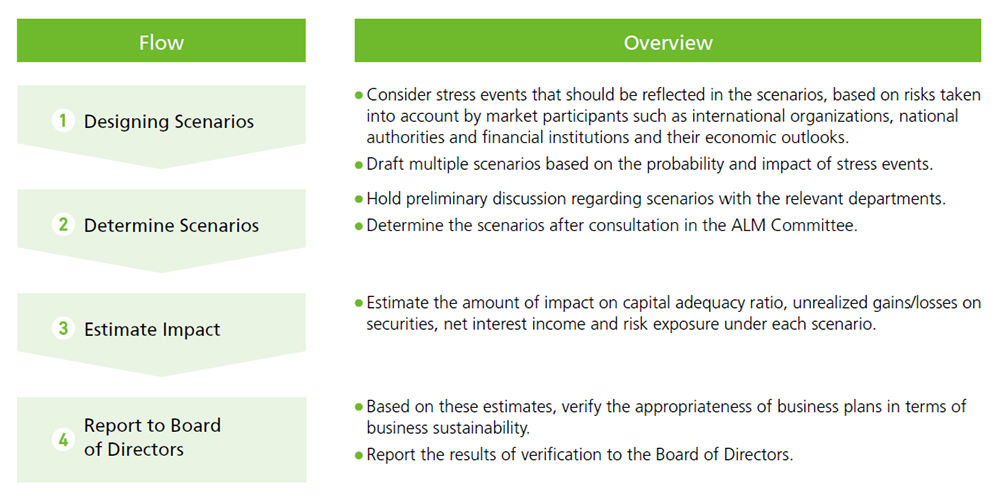

For quantitative management, we have introduced integrated risk management to quantify and control risks. Specifically, we set in advance the total amount of risk-taking that can be covered by total capital, allocate risk to risk-taking operations according to the type of risk and the characteristics of the business (risk capital allocation), and use value-at-risk (VaR)—a statistical method for estimating the maximum loss that might occur with a certain probability on assets and liabilities held—as a uniform measure to quantify market and credit risk and to control the risks taken. In addition, we conduct stress tests based on multiple stress scenarios that assume a deteriorating macroeconomic environment to verify the appropriateness of management plans from a forward-looking perspective and from the standpoint of management sustainability.

How stress tests are conducted

Qualitative management is conducted in conjunction with quantitative management in accordance with the characteristics of each type of risk. For example, regarding operational risk, we have established a PDCA cycle that includes a unified process for risk identification, assessment, management, and reduction.

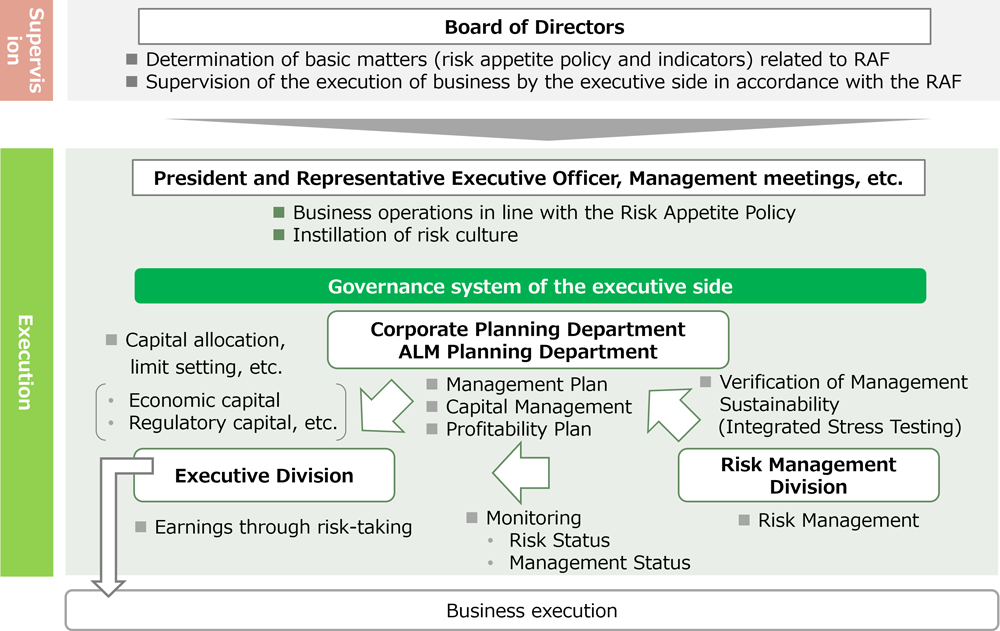

The allocation of risk capital is determined by the President & CEO, Representative Executive officer based on the total amount of allocated capital approved by the Board of Directors, following consultation with the ALM Committee and the Executive Committee.

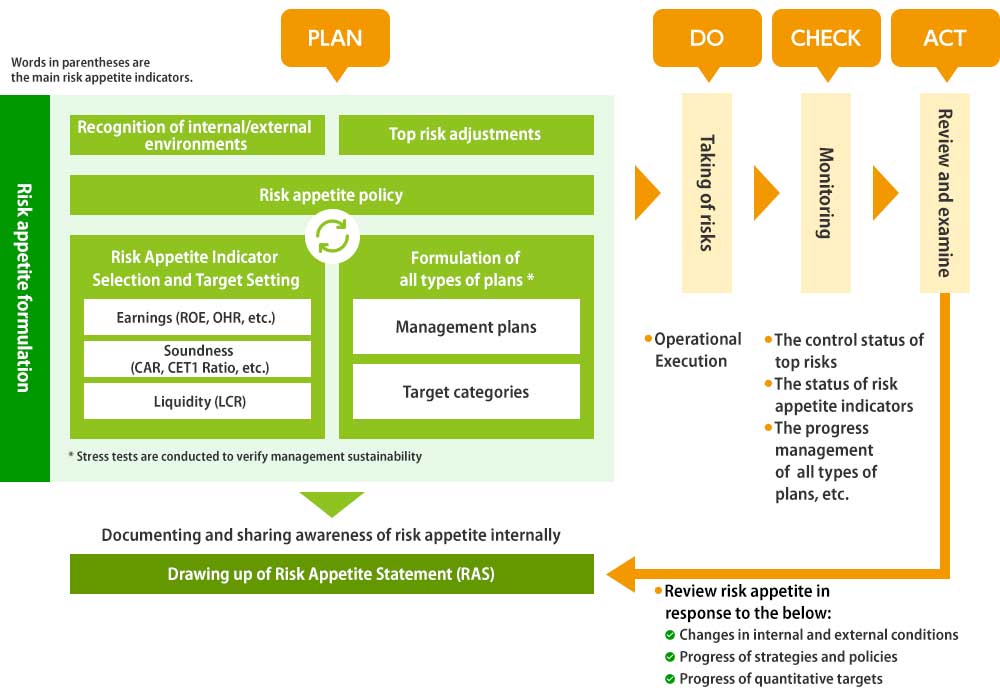

Risk Appetite Framework

The Bank introduced a Risk Appetite Framework (RAF)*1 to ensure stable and medium to long-term profitability while maintaining financial soundness. Based on the RAF, risk appetite policies and indicators as well as top risks are discussed in conjunction with the formulation of management plans.

In addition, the Executive Committee and the Board of Directors receive quarterly reports on the status of control of top risks and evaluate the effectiveness of the risk management process by the RAF.

- *1:

- A business management framework used as common language between banks pertaining to all aspects of risk-taking policies, including the capital distribution and profit maximization of risk appetites (the type and total quantity of risks a company should willingly take on to fulfil its business plans after taking into account the unique aspects of the company’s own business model).

Risk Appetite Framework Management Process

Role of the Supervision and Execution Side

Selection of Top Risks

Within the RAF framework, Japan Post Bank selects the top risks that we recognize as potentially having a particularly significant impact on our business, performance, and financial position. These risks are selected following deliberation by the Board of Directors and Executive Committee and in consideration of their degree of impact and probability.

Moreover, we reflect the actions we take against the selected risks in our management plans and take additional action as necessary following regular checks of the control status.

Top risks and measures

| Top risks | Main measures |

|---|---|

| Rapid changes in market conditions, such as a sharp widening of overseas credit spreads and a sharp rise in interest rates Downward deviation from the assumed investment multiples and exit timing of private equity funds |

|

| Cyberattacks |

|

| System failures |

|

| Large-scale disasters |

|

| Insufficient promotion of digital transformation, administrative efficiency, and other measures, and insufficient response to the competitive environment (changes in the banking industry) |

|

| Occurrence of scandals, compliance violations such as leakage or loss of personal information, and inappropriate conduct by officers and employees |

|

| Risks of customers suffering disadvantages due to failure to thoroughly implement customer-oriented business operations |

|

| Impediments to strategy execution due to human capital shortages |

|

| Inadequate measures against money laundering, terrorist financing, and proliferation financing |

|

| Inadequate measures to maintain and strengthen the customer base |

|

| Risks arising from issues related to sustainability, such as climate change, natural capital, biodiversity, and human rights |

|

Risk Appetite Policy

Japan Post Bank formulates a basic policy (Risk Appetite Policy) every fiscal year that indicates what risks and to what extent the company as a whole will take risks to earn profits, etc., based on the recognition of the internal and external environment, etc.

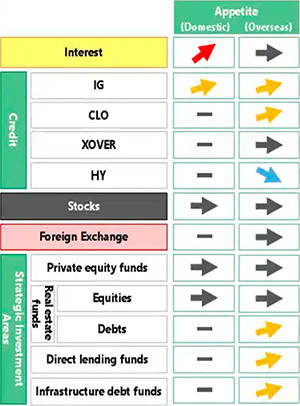

For example, with regard to investment management and ALM operations, the Company currently has a policy of conducting flexible portfolio management based on the market environment with an awareness of improving return relative to risk while strengthening risk tolerance, and determines the direction of risk-taking for each investment product (investment strategy).

During the term, the PDCA cycle will be accelerated and the risk appetite policy will be revised in response to major changes in the market environment and progress in quantitative targets.

Investment and ALM Operations

(As of 2025/3)